A few months ago, we launched Quantcha Unlimited—an offer that bundled our options trading platform with commission-free trading—for just $99/month. The response we’ve received since then has been pretty surprising.

First, a lot of people have seen the offer and jumped on it immediately. This part actually wasn’t surprising at all. They’ve come from across the investor spectrum, from beginners to seasoned veterans. It doesn’t take much experience to understand that you need high-quality tools to succeed in options trading. You also need extremely low transaction costs to make sure that you keep the lion’s share of your profits. We offer both, and most people love it when they see it.

But are we for real?

At the same time, we have also received our fair share of disbelief and skepticism. You can’t blame investors for being cynical. There are so many empty promises and downright scams out there that it’s become impossible to believe offers that seem to good to be true. Some companies charge 10x more than we do for their tools, so could we really deliver a compelling product at this price point? And how good could the trading experience really be if our flat fee was less than a few days of trading commissions on the major brokerages?

We also don’t have much brand recognition. We don’t spend on advertising, so most of our customers have come through direct outreach and word-of-mouth. But over the past five years we’ve quietly evolved into a company that offers one of the industry’s most comprehensive options platforms. Our features meet the demanding needs of investors, provide seamless brokerage integration, and include commission-free trading. Across our trading platform, custom APIs, and proprietary data feeds, our customers scale from legions of successful retail and professional traders all the way up through several of the world’s largest hedge funds, market makers, and quant traders. But not everyone is sold on who we are and what we offer.

Taking The Quantcha Challenge

To help address these concerns, we kicked off an initiative in January of this year called The Quantcha Challenge. This endeavor is a reference to the famous marketing campaign Pepsi launched in 1975. At the time, Pepsi was nearly a century old, but they were somewhat of an upstart rival to the dominant Coke. They believed they had a superior product, but getting diehard Coke fans to even try it was difficult. So, they found the best way they could to get people to give them a shot—and it worked. If you bought Pepsi stock back then, it would have returned you nearly 200:1 by now.

I didn’t think it would be appropriate to hang out in a supermarket parking lot trying to get people to drink a brown liquid out of an unmarked Dixie cup, so we took a slightly different route to prove our point.

We started The Quantcha Challenge on January 9, 2019, with an empty $26K portfolio. We have since broadcast live on YouTube every market day showing how we use our own tools to build and manage a real-money portfolio. No cuts, no editing, no safety net. Along the way we also answer user questions, discuss option & market theory, and highlight our new and continuously expanding features.

Goals of The Quantcha Challenge

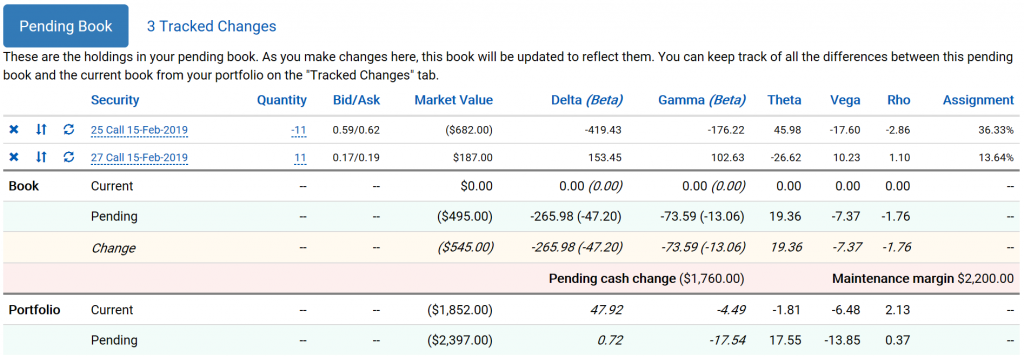

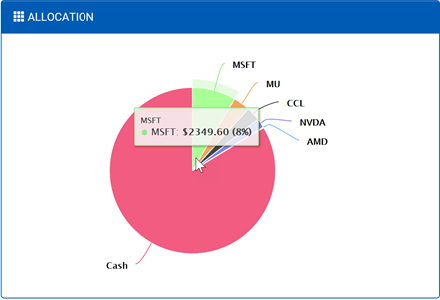

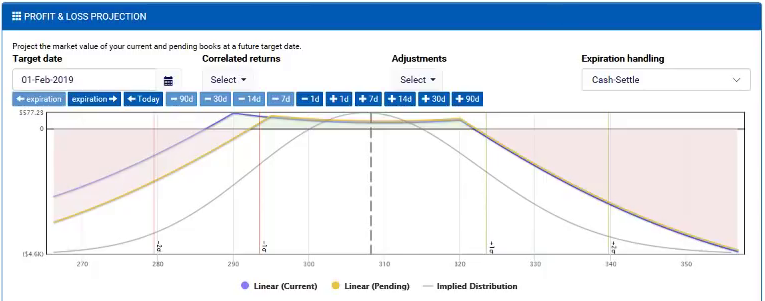

While our primary goal is to help people see the platform in action, we also put some basic parameters in place for managing a successful portfolio. We want to be responsible with our investments, so we minimize our portfolio’s volatility through position sizing and opportunistic hedging. We also use our tools to keep our overall positions in a beta-weighted-delta-neutral state. In other words, we want to build a portfolio that grows in value regardless of the movement of the overall market. We spend a great deal of time in the broadcasts explaining why we take on the trades we do, as well as how to understand how a given trade impacts the portfolio’s exposure to the market at-large. Plus, our platform is designed to make things like this incredibly easy to understand and implement.

In addition to minimizing the volatility of our performance, we also set a somewhat conservative goal: gain 1% in our first month. This might seem pretty modest, but we felt it was realistic to set the tone for our risk tolerance (or aversion). It would also be a good way to illustrate how well our tools would perform in finding profit without taking outsized risks. And if we could show how to consistently return that 1% every month, regardless of the market, it would be a great run.

So, how did we do?

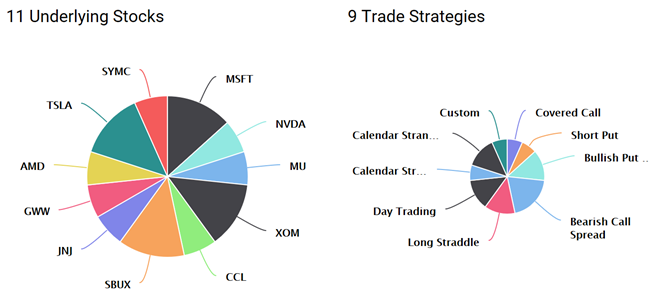

From a user education perspective, it was a smashing success. We were able to trade a wide variety of stocks using a wide variety of option strategies.

We showed off a considerable portion of our platform, and really punctuated how our underlying integration with Tradier delivers an extremely productive and seamless user experience.

And the best part was that we showed everything live so you could understand exactly what to expect as a Quantcha Unlimited customer. You get to see everything from trade idea genesis and optimization all the way through order fulfillment. This includes the quality and speed of the fills we get. This is a really important consideration for every investor, so please check it out in the videos and you won’t be disappointed. (In the interest of full disclosure, we got some feedback that watching us shave bid/ask spreads during order placement got boring, so we started managing them off the air.)

Now let’s talk about commissions

I mentioned earlier that we were surprised by some of the responses we received from some prospective customers when pitching our commission-free offer. Believe it or not, there are a lot of people out there who simply don’t mind paying a ton in commissions. As someone who has had many months where my commissions were in the thousands of dollars, I can understand where they’re coming from. But those days are long behind me now, and I hope they will be for you, too.

Let’s discuss the impact commission-free trading has on options investing. It is a monumental game-changer, especially when we have the tools to really take advantage of it. Let’s start off by reviewing The Quantcha Challenge portfolio returns since its launch a few weeks ago.

The portfolio started with a cash balance of $26,024.77. Setting aside the $99 monthly fee for Quantcha Unlimited, the closing value after 17 trading days was $26,884.22 for a 3.3% gross gain of $859.45. We filled well over 50 individual trades, but we’ll use that number to be conservative. Those trades covered a total of 657 contracts, and we had one leg assigned and another exercised. As a side note, our efforts to maintain low volatility of returns was successful as our lowest point was only down -0.68%.

The economics of commission-free trading

If we used a major brokerage that has a per-trade and per-contract commission structure, we’d expect to give up a lot of this gross profit. But exactly how much? Well, let’s take a look at some representative structures that may or may not line up with the latest published data from the sites of major brokerages.

First, what about $6.95 per trade and $0.75 per contract with a $19.99 exercise/assignment fee?

| Per Trade | Per Contract | Assign/Exercise | Monthly | Total Cost | Net | Return |

| $6.95 | $0.75 | $19.99 | $0 | $880.23 | -$20.78 | -0.08% |

We would have paid more in commissions than we made. It might seem unbelievable, but we’d actually manage to turn a 3.3% gross profit into a loss. It would be bad (for us, at least).

Here’s another example of a possibly theoretical broker with a more competitive commission structure.

| Per Trade | Per Contract | Assign/Exercise | Monthly | Total Cost | Net | Return |

| $4.95 | $0.65 | $4.95 | $0 | $684.45 | $175 | 0.67% |

This is somewhat better, but that’s not saying much. I guess at least we’d get to keep around a quarter of the profits. It would still be a bummer to not reach our 1% goal.

And now, Quantcha Unlimited.

| Per Trade | Per Contract | Assign/Exercise | Monthly | Total Cost | Net | Return |

| $0 | $0 | $9 | $99 | $117 | $742.45 | 2.85% |

The numbers are clear. With Quantcha Unlimited, you keep more of your profits. But commission-free trading is about so much more.

Intangible benefits of commission-free options trading

One major benefit is the frequency we can hedge and day-trade options. We’re not talking about “get rich quick”-style day-trading, but rather the kind of trades we place and decide to adjust once or more over the course of that same day. When we have to consider per-trade and per-contract commissions, it really disincentivizes us from updating positions to meet the goals we have for our portfolio. Even when the transaction costs may not be prohibitive, sometimes it’s just a psychological pressure that we don’t want to “waste” a few dollars on what might already be a razor-thin trade margin.

This also applies to partially filled orders. Sometimes we manage to nail the pricing so perfectly that we can only get part of our order filled. But then the opportunity changes and we’re stuck with part of our order unfilled. With per-trade commissions, you’ll typically need to pay a new trade commission if you cancel and replace the remainder of your order at a new price. Without per-trade commissions, it doesn’t matter how many separate trades it takes to get your quantity filled.

Commission-free trading also expands the world of options we can profit from. We don’t need to worry about transaction costs eating heavily into options trading in the pennies whether opening or closing. We can just place the trade that’s right for our portfolio.

Another major impact of commission-free trading is that it reduces the costs of legging in to and out of positions. Sometimes we have to be creative about getting the best entry, and legging in or out of illiquid options or complex trades with fewer potential counterparties is the only way to get the best pricing.

A real-world example

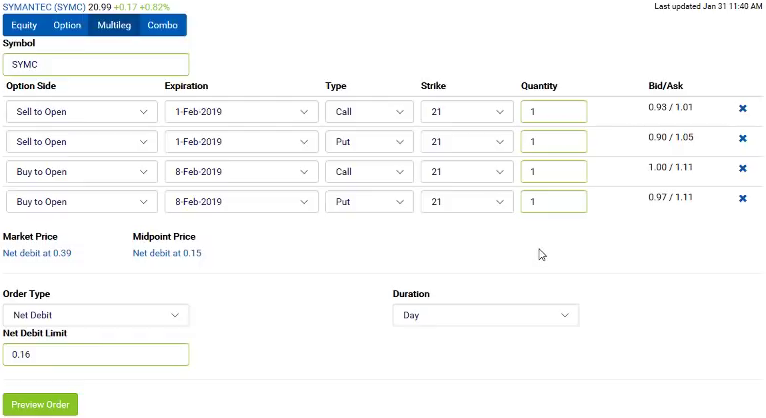

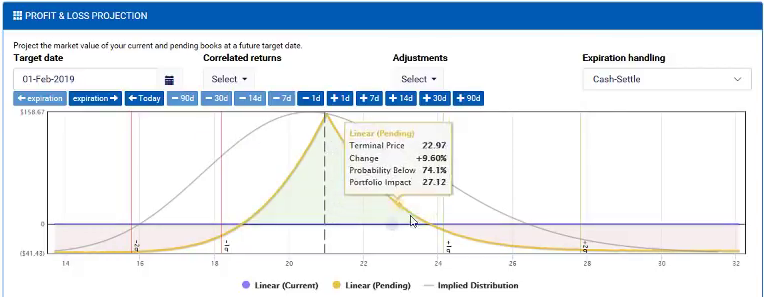

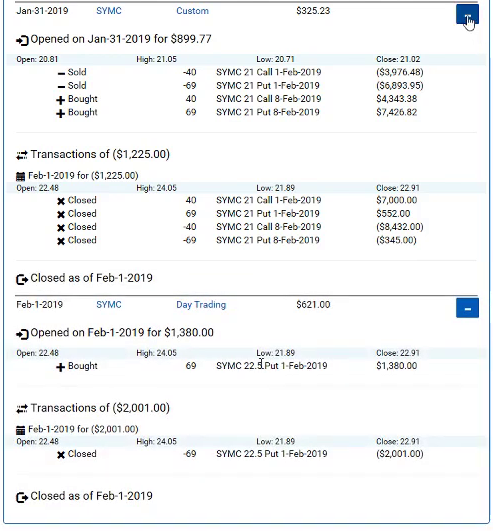

A good example of these benefits is an overnight Symantec earnings trade we placed for The Quantcha Challenge portfolio. The options weren’t particularly liquid, so we had to separate each leg of our calendar straddle into its own order. As part of this, we received some partial fills and had to replace those orders at different pricing to get the full positions we wanted.

The next day, we decided to roll one leg up to capture some short-term profit while closing the others out one by one. We were able to more than double our original $900 investment, which was great. However, with leg quantities of 69, 69, 40, and 40 contracts, we would have racked up nearly $300 in transaction fees with one of the major brokers.

If you want to learn more about this specific trade, you can check out the trade setup here and discussion of closing it out here. All episodes of The Quantcha Challenge are available on YouTube, so you can follow it from the first day all the way through today.

I hope you check out what we have to offer and consider how commission-free trading with our platform fits in to your investing. And if you have any feedback, please let us know at hello@quantcha.com.

As always, good luck, and good hunting.

Ed