Option Trade Analyzer

Critical analysis for your potential option trades.

- Uncover potential problems with the risk-neutral trade review

- Get the full picture based on probable outcomes

- Dig deep with comprehensive data

- Watch overview video

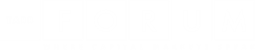

Uncover potential problems with the risk-neutral trade review

Our quantitative approach to trade analysis reviews the most common concerns option investors have when opening new positions. This includes everything from expected dividends and earnings announcements to risk/reward projections, option liquidity warnings, and probability of profit.

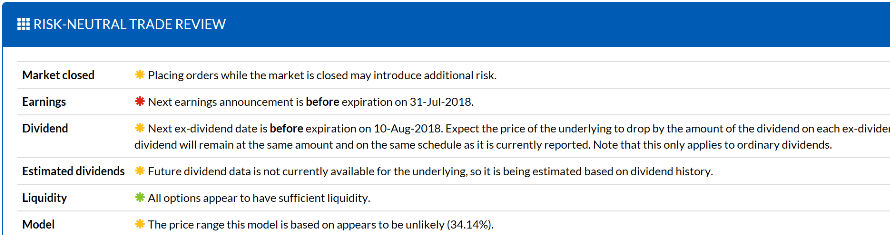

Get the full picture based on probable outcomes

In addition to modeling returns for your provided model, our trade analyzer includes a full implied range analysis that models your trade against the 99.7% projected range implied by market sentiment. This analysis helps you understand what could happen if the underlying moves against your expected view so there are no surprises down the road.

Dig deep with comprehensive data

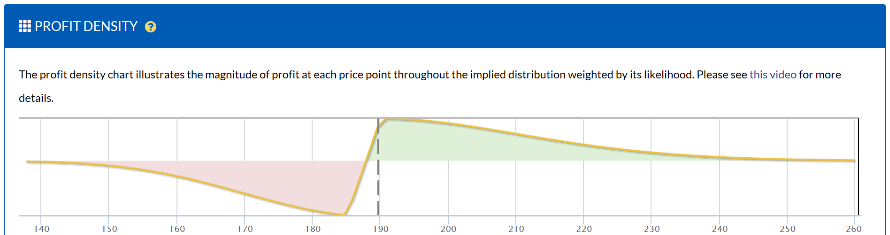

The potential and impact of your trade reaches beyond modeling potential outcomes. That's why we include some of the most innovative views into market data. From profit density diagrams to volatility skews and even the Greeks, you'll have what you need to critically review your potential trade from every angle before you pull the trigger.