Quantcha Options Suite

Power tools for successful option investors.

Get started » Documentation » Training » I'm Here To Dominate Earnings »

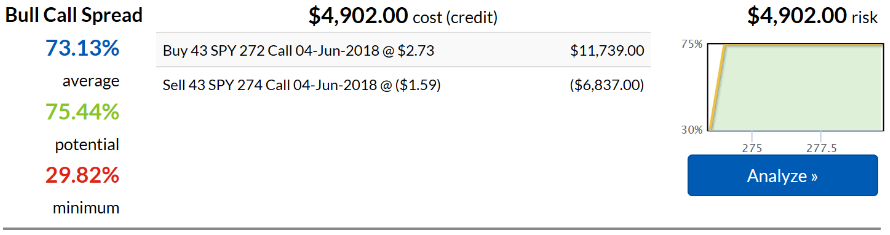

Option Search Engine

Turn a great stock idea into a great options trade.

- Search for optimal trades based on a stock, timeframe, and price target

- Filter and sort trades to discover your favorites

- Easily understand every trade at a glance

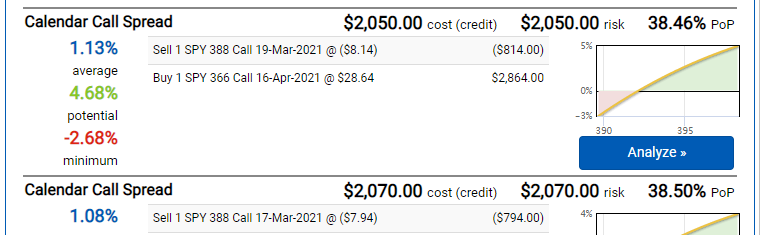

Calendar Search

Identify optimal calendar trades for a target date and view.

- Search for multi-expiration spreads for a specific date and view

- Filter near and far term options based on expirations, strikes, and deltas

- Review calendar opportunities in the trade analyzer

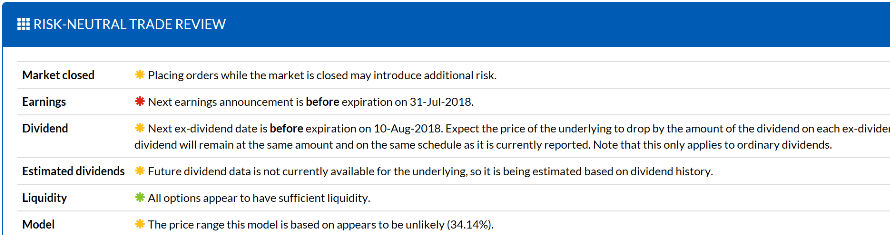

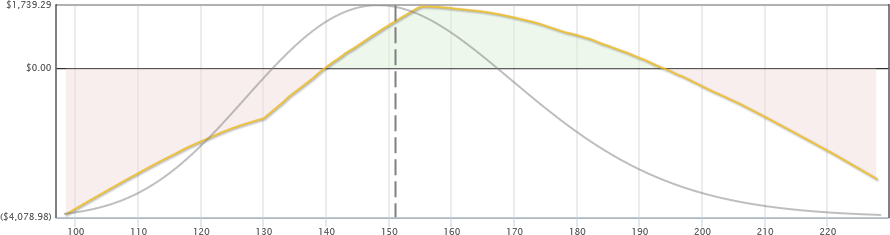

Option Trade Analyzer

Critical analysis for your potential option trades.

- Uncover potential problems with the risk-neutral trade review

- Get the full picture based on probable outcomes

- Dig deep with comprehensive data

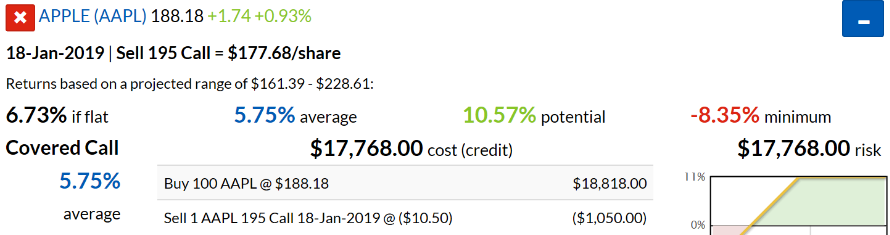

Stock & Option Trade Screeners

Screen the entire market for ideal stocks and trades.

- Uncover the best optionable stocks

- Zero in on the best available trades for your favorite strategies

- Get an edge with our proprietary data

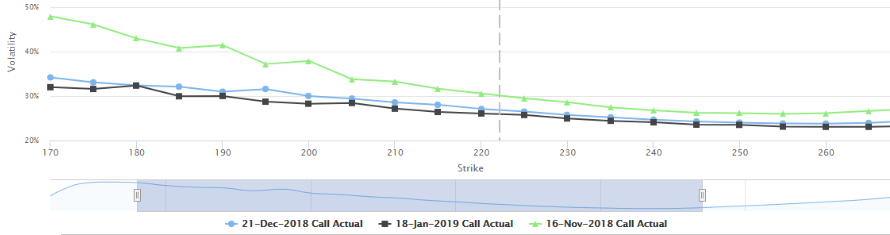

Stock & Option Charting

Turning data into knowledge so you can turn insights into trades.

- Plot a variety of key option data points to easily discover outliers

- Model technical trading positions one chart click at a time

- Stock charting that satisfies seasoned technical analysts

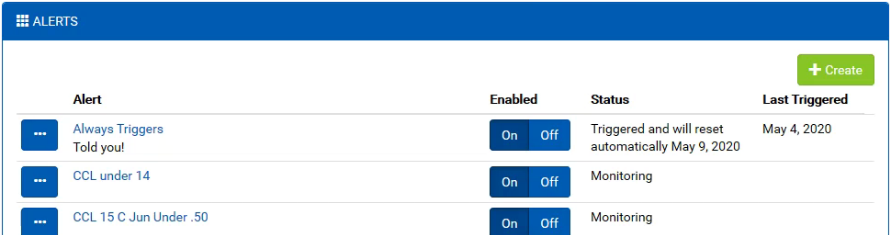

Quantcha Alerts

Stay on top of your investments with proactive market and portfolio notifications.

- Configure alerts based on timeframes, market data, and portfolio scenarios

- Customize alert parameters to fine-tune the type of notifications you receive and when

- Define alerts linked to your brokerage accounts to track account, portfolio, and trade progress

Option Portfolio & Book Manager

Management tools to put you in control of your options.

- Simulate the future value of your options book

- Experiment with changes and compare performance between books

- Discover efficient ways to meet book goals, such as delta-neutral balancing

Option Trade Tracking & Reporting

Flexible in-depth tracking of your past and current trades.

- Visualize distribution across underlyings, strategies, and performance

- Filter and sort by entry date, underlyings, strategies, and more

- Track trade progress across opens, rolls, expirations, and closes

- Data & API »

- Watch training videos