Dominate Your Earnings Trades

Dominate earnings

Our comprehensive end-to-end options platform provides industry-leading support for identifying earnings opportunities, optimizing trades, tracking & monitoring positions, and reviewing your historical performance. Plus, we support direct integration with major US brokerages so you can do everything you need to without leaving Quantcha.

Master the trade

Once you've found a promising opportunity, our robust trade analyzer will help you understand everything you need to know before you pull the trigger. We'll show you the current market expectations for the underlying, the probability of profit, and more.

Get even more

When you subscribe, you'll get access to a broad array of features from our platform, including our powerful stock options search engine, a variety of marketwide screeners, and robust trade analysis and book mangagement tools that are all integrated for easy access and available on any modern device.

The Top 10 Quantcha Features For Earnings Investors

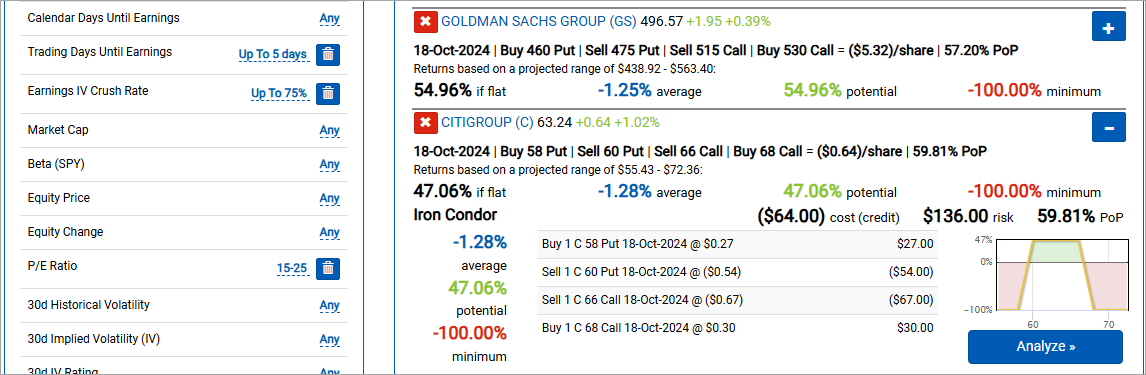

Screen the market for ideal opportunities

Take advantage of a variety of marketwide strategy screeners to filter and sort potential opportunities by dozens of standard and proprietary metrics , including Quantcha's innovative Quantcha Earnings Crush Rate™, and Quantcha Volatility Rating™, Quantcha Option Liquidity Ratings™.

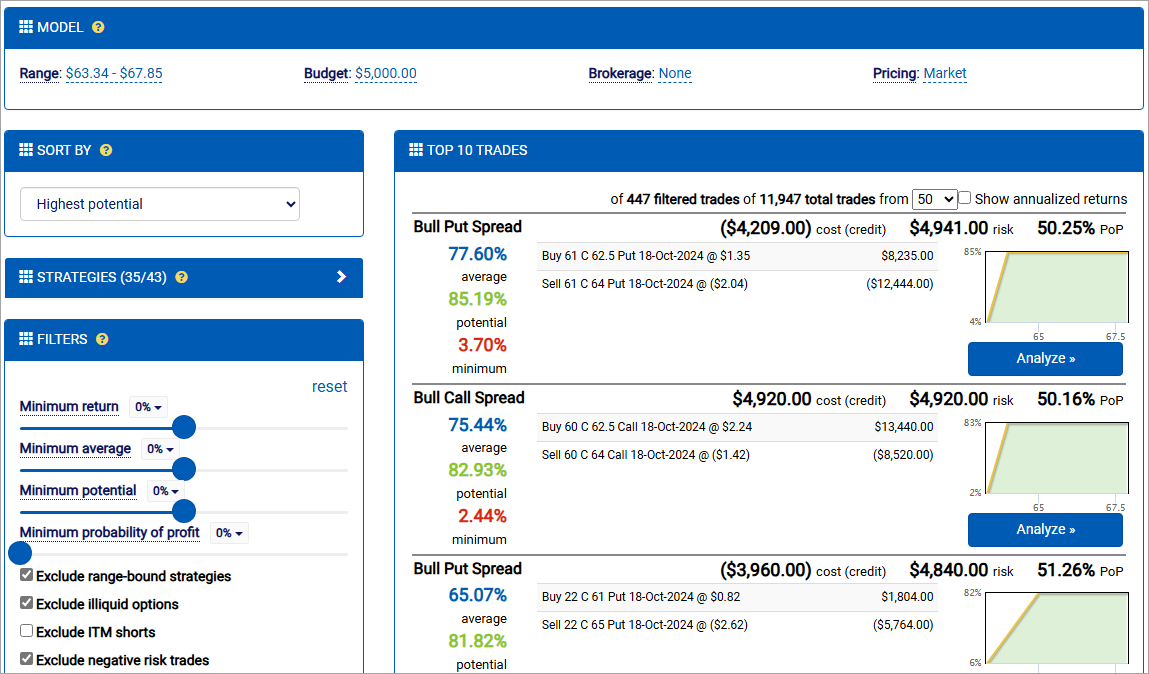

Find optimal strategies for your view

If you already know which stock you want to trade, jump right into the Options Search Engine to identify the best trades to express your underlying view. This enables the most precise control over bullish, bearish, and neutral strategies by allowing finely-tuned control over how the universe of trades are analyzed. Learn more about the Options Search Engine in our free course.

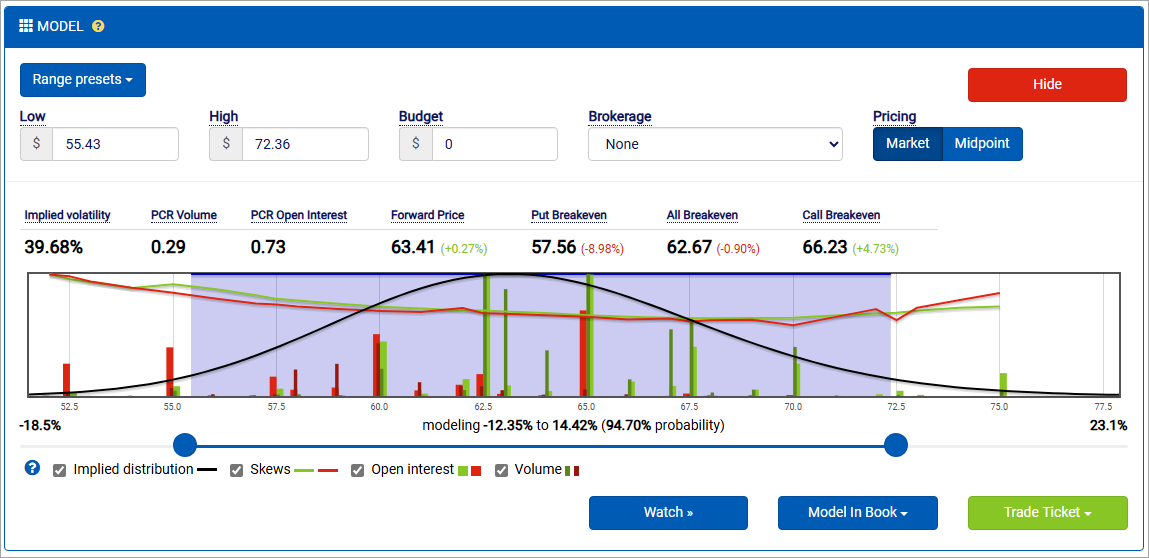

Refine your market view

Use the Trade Analyzer's Model Designer to refine your market view. The Visual Option Chain helps you easily understand where other investors are trading and holding options so that you can gauge market sentiment and the likelihood of your view playing out based on current conditions.

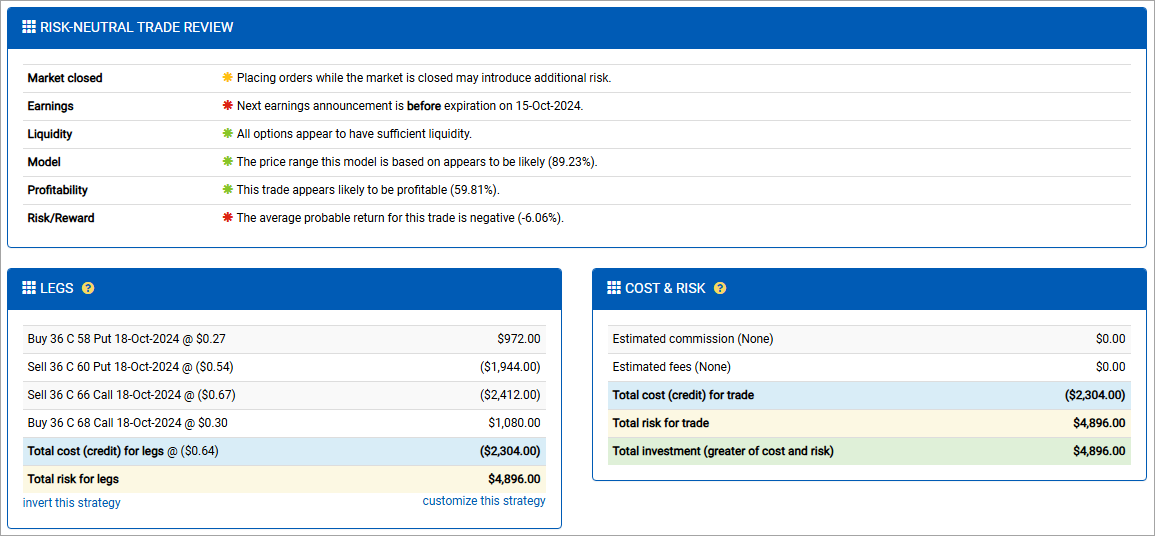

Analyze & optimize trade entry

Quickly identify and understand potential risks to your strategy using the Risk-Neutral Trade Review. You can then adjust the legs of your trade to zero in on the exact risk profile you're looking to take on.

Understand expected outcomes

Rely on Quantcha's extensive use of charts and graphs to easily understand the peaks and valleys of your strategy's profit potential. This includes innovative visualizations like the Profit Density Diagram to help you quickly identify the scale of opportunities and risks relative to their probability.

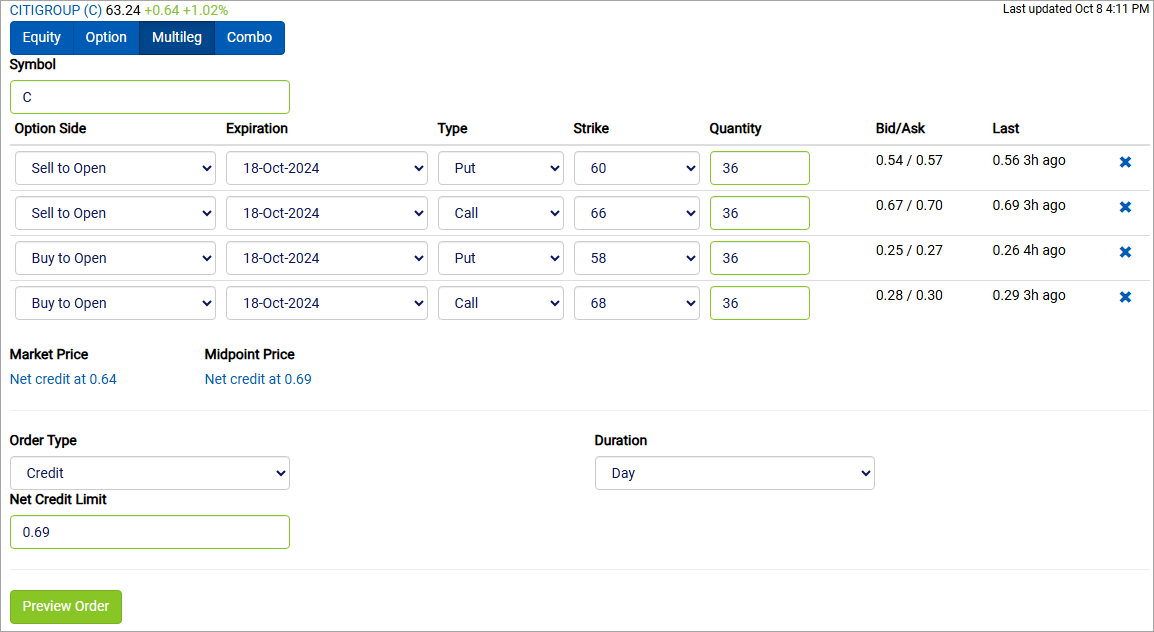

Execute quickly with integrated trading

Link with a supported brokerage like Charles Schwab or E*TRADE to bring key account details and real-time market data into your Quantcha experience. This includes an integrated trade ticket and order management support so you can quickly capitalize on opportunities.

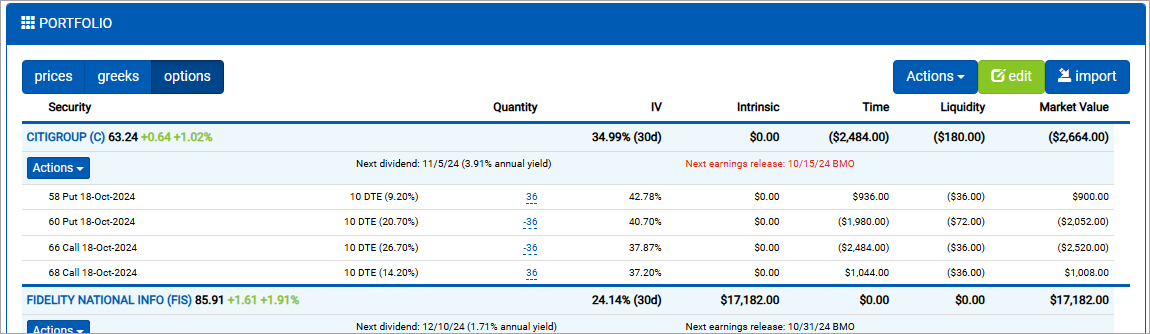

Stay on top of your strategies with the Portfolio Tracker

The Portfolio Tracker provides key insights for your current positions, as well as shortcut access to key features like the Book Manager and Quantcha Alerts. In addition to views for market prices and Greeks, you can even take a deep dive into your option positions to better understand their value based on a decomposition into their intrinsic, time, and liquidity components.

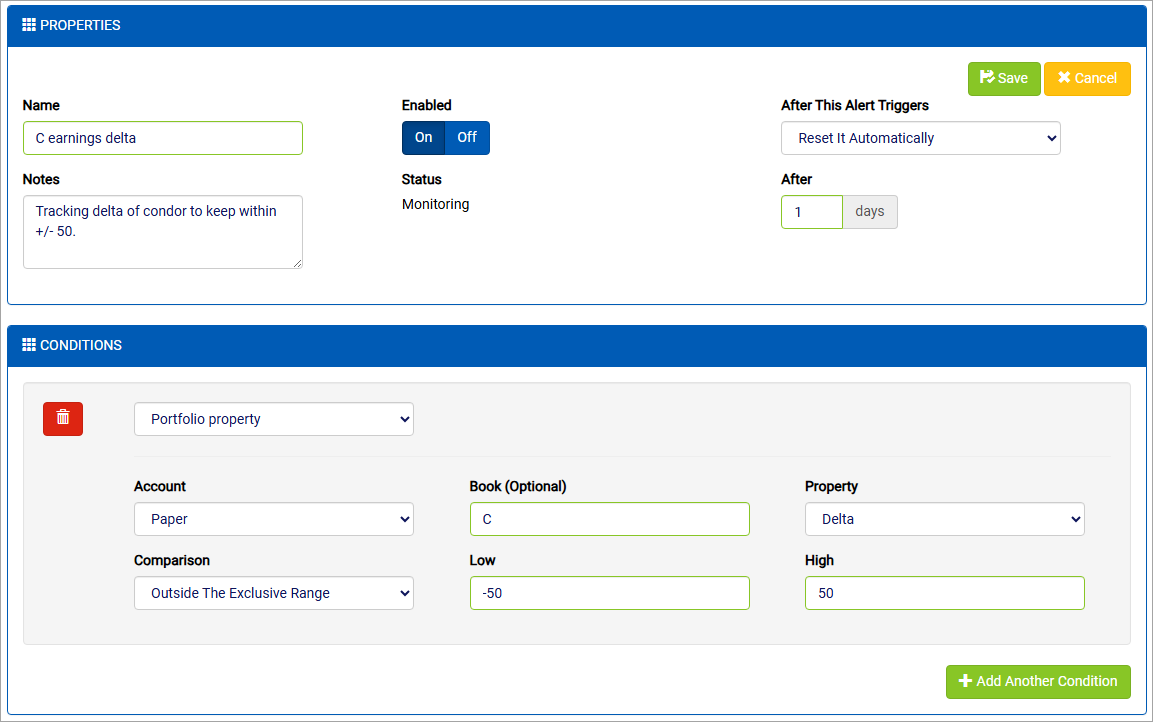

Monitor the market and your portfolio with Quantcha Alerts

Use Quantcha Alerts to track conditions so you can quickly respond. Easily set up alerts that watch for upcoming earnings and ex-dividend dates for underlyings covered in your portfolio. You can even track conditions like balances and Greeks to ensure that your risk always stays within preferred boundaries. Learn more about Quantcha Alerts in our free course.

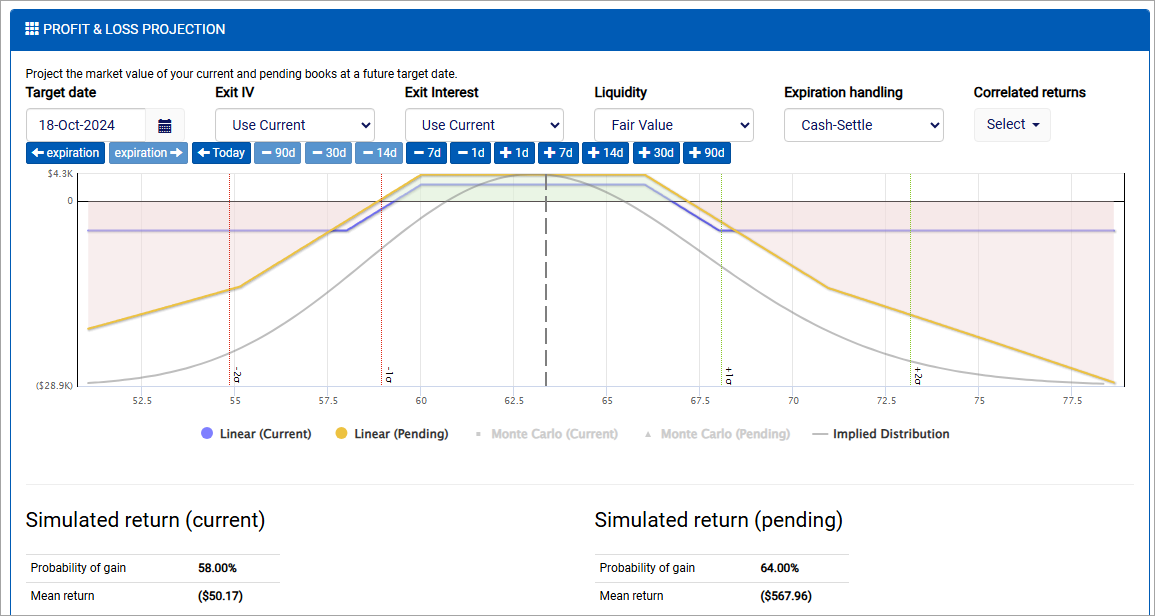

Model prospective changes with the Book Manager

Use the Book Manager to experiment with changes to your holdings to examine how those changes impact your expected returns. You can also adjust future implied volatility and the risk-free rate to compare before and after views of your strategy. Learn more about the book manager in our free course.

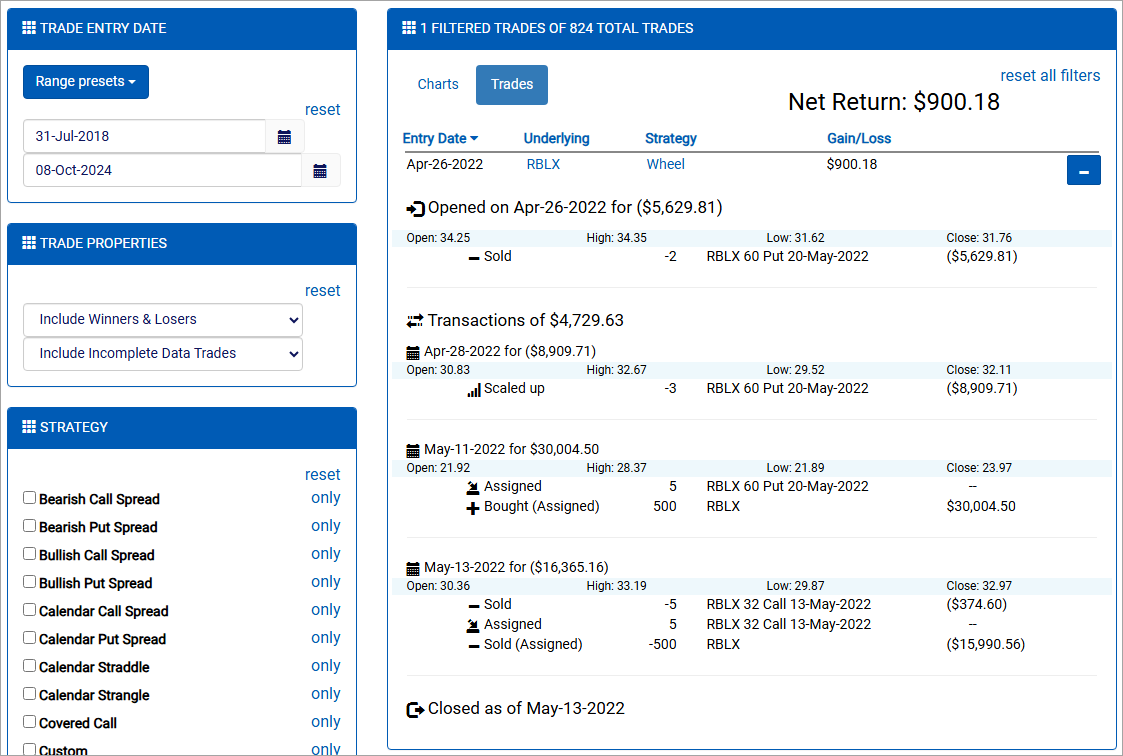

Refine your craft with Trade Tracking & Reporting

Use the Trade Tracking & Reporting tools to rehydrate a full trading history from your brokerage-linked account's transaction history. It delivers all the benefits of a trading journal without any of the effort! These tools provide a variety of visualizations and analyses of your trading history to help you understand how your strategies have performed.

Detailed Research

Looking to learn more about trading earnings with options? Check out our free detailed research report that dives into the real world performance of a variety of option strategies over a six-year period. It's a great way to get started!

Training & Tutorials

Want to get the most out of Quantcha? Check out our free, self-paced online training courses that walk you through using the platform with easy-to-follow steps and annotated explanations of concepts and features.

Videos & More

Looking to learn more about trading earnings with options? Check out our free detailed research report that dives into the real world performance of a variety of option strategies over a six-year period. It's a great way to get started!