Option Portfolio & Book Manager

Management tools to put you in control of your options.

- Simulate the future value of your options book

- Experiment with changes and compare performance between books

- Discover efficient ways to meet book goals, such as delta-neutral balancing

- Watch training series

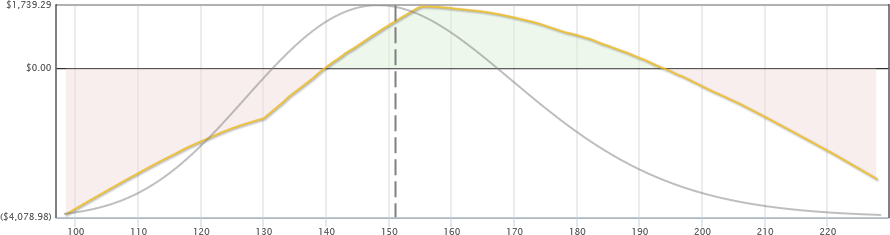

Simulate the future value of your options book

We employ a variety of sophisticated techniques that enable us to accurately project the value of your book at any future date. Have options that expire between now and your target? Just pick the expiration strategy you want to model and we'll take care of it for you. We also offer two different price path modeling strategies: linear progression and Monte Carlo.

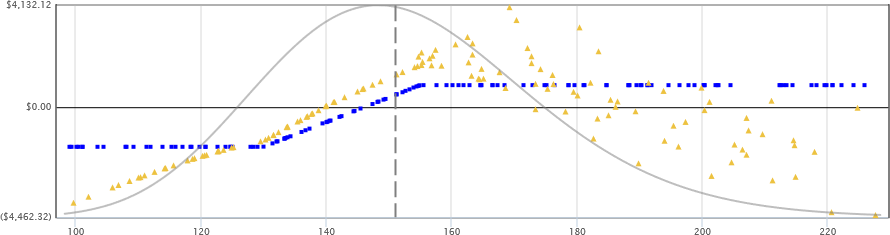

Experiment with changes and compare performance between books

Trying to decide whether you should adjust your book? Our tools offer the features you need to experiment with any position change so that you can compare how those changes would fare versus your current holdings. As you make changes to your pending book, we track the transactions required for you to transition from your current portfolio to the new one.

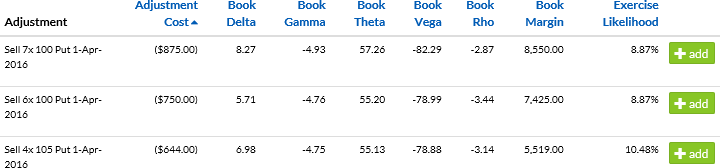

Discover efficient ways to meet book goals, such as delta-neutral balancing

Our automated adjustment search provides a great way for you to find the trades that meet specific goal criteria for your book and transactions. Whether you're trying to balance your greeks or just earn some extra income while keeping your margin requirements in check, our adjustment search makes it easy to find the most efficient ways to get the results you're looking for.