Quantcha Alerts

Stay on top of your investments with proactive market and portfolio notifications.

- Configure alerts based on timeframes, market data, and portfolio scenarios

- Customize alert parameters to fine-tune the type of notifications you receive and when

- Define alerts linked to your brokerage accounts to track account, portfolio, and trade progress

- Watch overview video

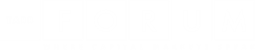

Configure alerts based on timeframes, market data, and portfolio scenarios

You can combine a variety of alert conditions, which include timeframes, stock and option properties, and portfolio scenarios, such as likely option assignment, to receive alerts when key opportunities and risks arise.

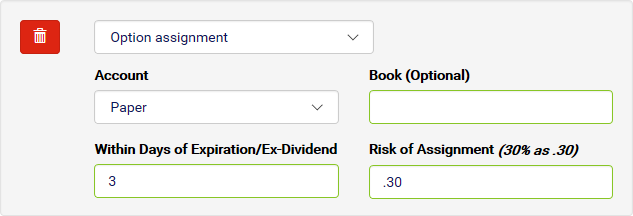

Customize alert parameters to fine-tune the type of notifications you receive and when

Every condition allows you to specify parameters that fine-tune the type of notifications you receive and when. You can decide how far out to keep an eye on ex-dividend dates, and at what assignment risk you’d like to be alerted for your short calls.

Define alerts linked to your brokerage accounts to track account, portfolio, and trade progress

If you link a brokerage account with Quantcha, you can configure alerts that watch your portfolio for important conditions, such as approaching earnings dates or opportunities to close positions at a desired price.