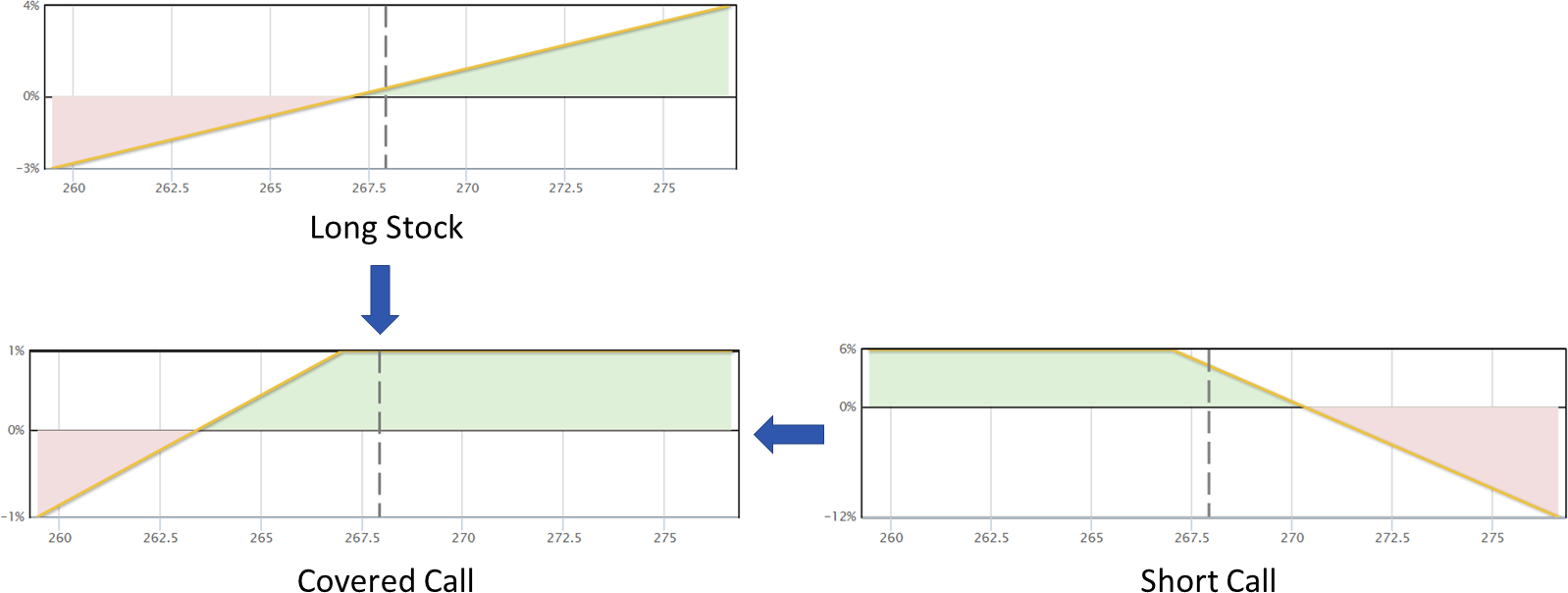

Selling covered calls is a tried and true strategy for long-term investors, but stock selection is the trickiest part.

Every covered call trade involves three decisions: the underlying stock, the term, and the strike. Depending on your investment goals, there are many ways to select each. Quantcha provides tools for each step of the process, as well as great tools for managing the positions once open.

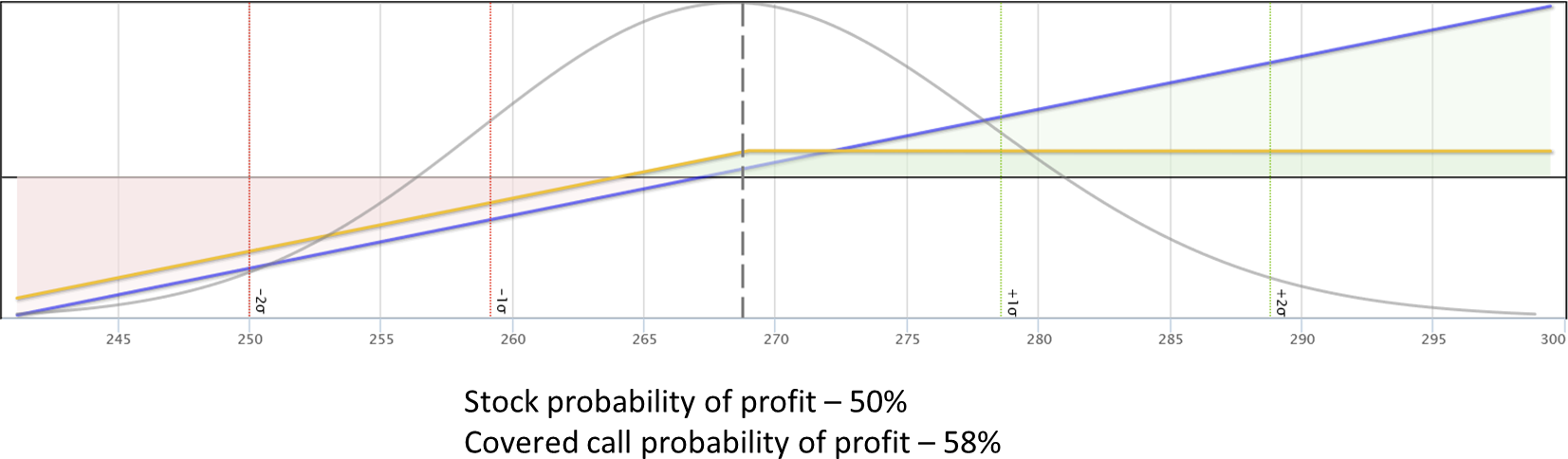

Let’s focus on some considerations for selecting the underlying stock. One thing most investors will advise is that you only work with stocks you want to own. Covered calls are an equity-centric options strategy, so your returns will correlate with the performance of the stock. If you pick a stock that steadily declines, you’ll have a hard time turning a profit.

The next thing you’ll want to consider is whether you consider the premium available to be worth the risk. This is the most important part of option investing because the profit almost always comes from you being right when the market is wrong. The best proxy for the market’s sentiment of a stock’s risk is its implied volatility, and its options are, by definition, priced for that risk. So if you think the implied volatility for a given stock indicates that the market is expecting more risk than it’s worth, then it could be a good candidate for selling calls.

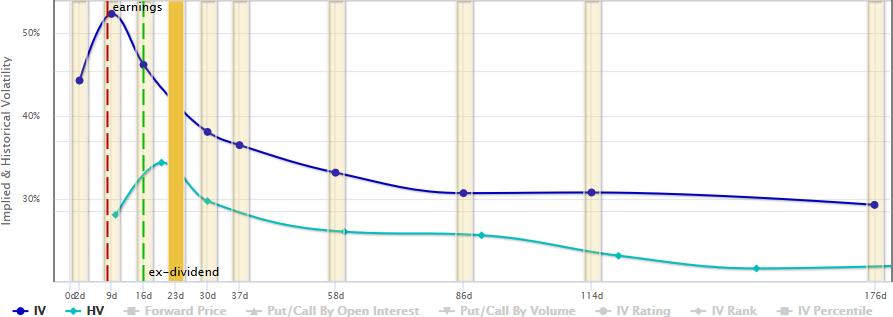

There are a lot of ways for evaluating the current implied volatility for a given stock. Our term view provides many of them in a single chart for easy comparison. One of the oldest methods is to simply compare the implied volatility with its historical realized volatility. The theory is that implied volatility will generally outpace the eventual realized volatility for that term, so selling it should be profitable in the long run. However, just be sure you’re doing a fair comparison. If one of those terms includes an earnings announcement and the other doesn’t, then the numbers will skew.

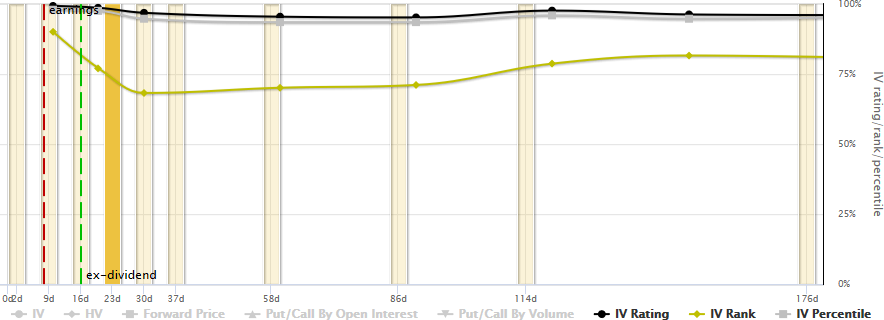

There are also metrics like IV Rating, Rank, and Percentile that will give you insight as to how the current implied volatility stacks up relative to historical implied volatility measurements for a stock. Of course, you should remember that a high IV valuation means that the market is priced for increased risk for a reason. If you want to learn more about implied volatility evaluation using these metrics, check out our video on that topic:

If you’re not quite sure which stock you want to consider for writing calls against, then check out our covered call screener. It extends our options-centric stock screener with additional filters for option- and trade-specific properties.

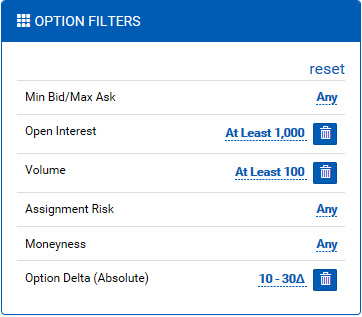

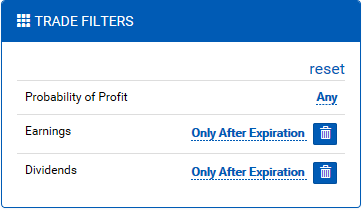

The option filters make sure that every proposed trade meets the specified requirements for pricing, open interest, moneyness, and more.

You can also use the trade filters to specify whether you want to include or avoid earnings announcements and ex-dividend dates.

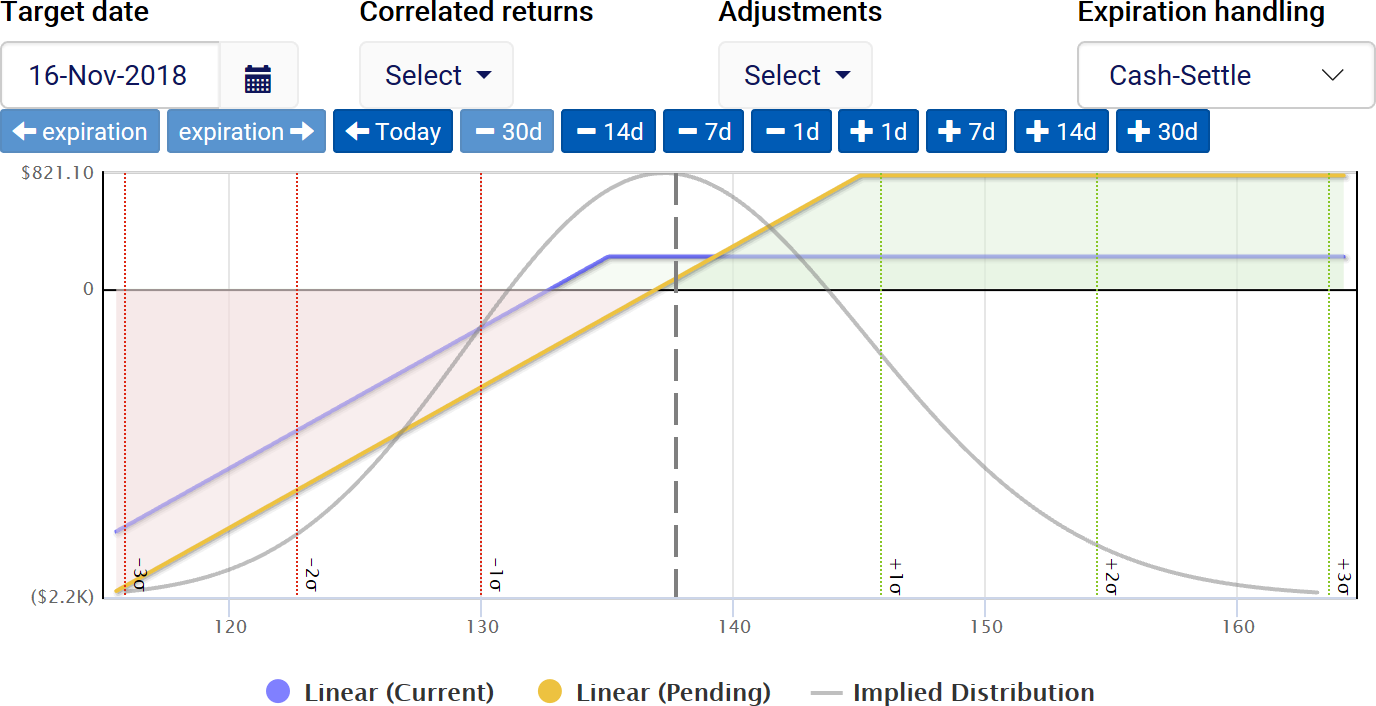

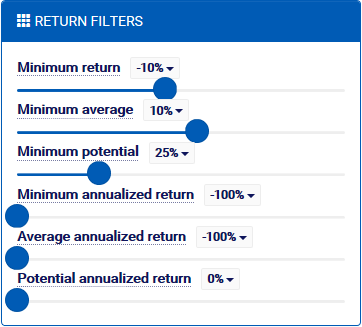

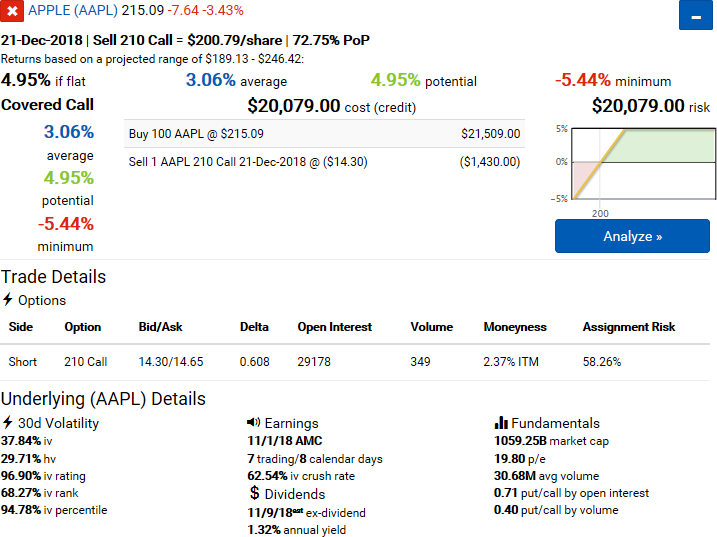

The return filters enable you to specify minimums for risk and reward, both in periodic and annualized forms. The returns are based on the default stock-specific model applied to each underlying for that term. For covered calls, each trade is evaluated against a price target range of a +/- 1-volatility movement at expiration. This risk-neutral approach ensures that trades with higher volatility stocks are considered equitably against those with lower volatility stocks.

Once you’ve set up your filters, it’s really easy to read the results. You get a trade summary, an execution plan, an expiration payoff diagram for the default model, and details on the option and underlying stock involved. With one click you can review the opportunity in the trade analyzer.

To learn more about our covered call screener, please check out the tutorial on YouTube:

To learn more about covered calls, please check out our YouTube training series: