There are so many risks and opportunities in the market at any given time. But you can’t spend all of your time staring at screens. You want to stay informed, and now there’s a way to do it even when you’re not on the job.

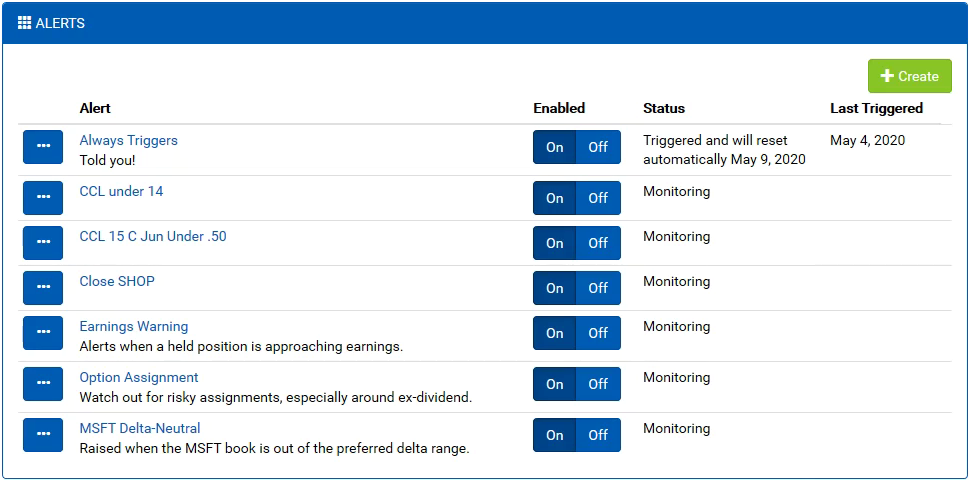

Quantcha Alerts is the part of Quantcha you never stop using. It’s an indispensable service that monitors the market (and your accounts, optionally) to keep you notified of important developments. Simply define a set of conditions, such as stock prices, position market values, or book delta ranges, and we’ll let you know when they’re all in play.

Alerts are configurable. You can combine a variety of alert conditions, which include timeframes, stock and option properties, and portfolio scenarios, such as likely option assignment, to receive alerts when key opportunities and risks arise.

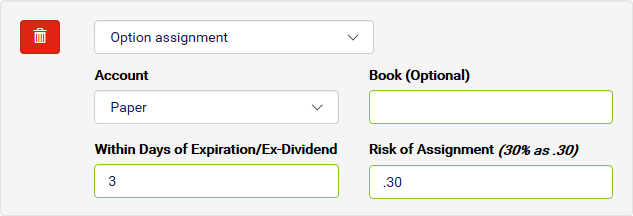

Alerts are customizable. Every condition allows you to specify parameters that fine-tune the type of notifications you receive and when. You can decide how far out to keep an eye on ex-dividend dates, and at what assignment risk you’d like to be alerted for your short calls.

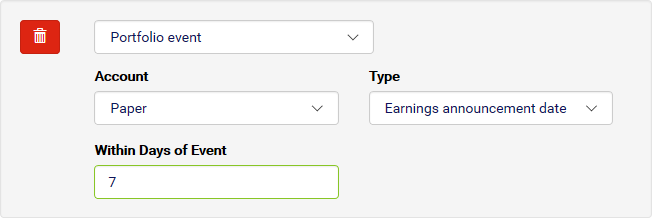

Alerts are integrated. If you link a brokerage account with Quantcha, you can configure alerts that watch your portfolio for important conditions, such as approaching earnings dates or opportunities to close positions at a desired price.

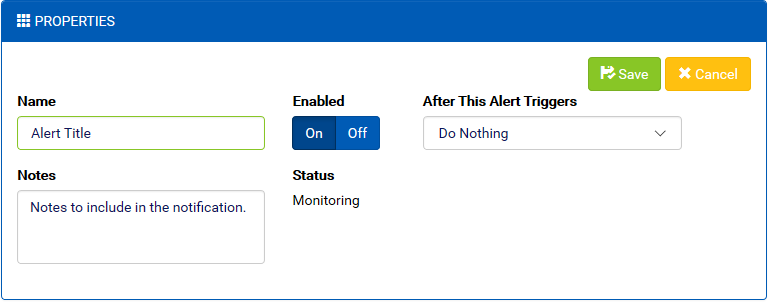

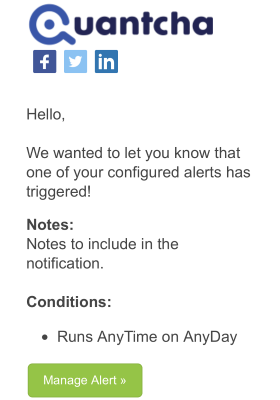

Setting up an alert is really easy. First, start off by entering a descriptive name. This will be used as part of the notification subject. You can optionally include additional notes that will be included in the body of the notification. This could be helpful to remind you why you created the alert in the first place.

Post-Trigger Actions

Next, decide what you want to happen After This Alert Triggers. There are several options.

Do Nothing leaves the alert in a triggered state. You have the option of manually resetting the trigger immediately or in a few days if you want to be alerted the next time all conditions are met. This is a good option if you expect to reuse the alert, possibly after modifying it.

Reset It Automatically will automatically reset the alert after the specified number of days. This is a good option if you have regular conditions you want to track, such as weekly option assignment risk.

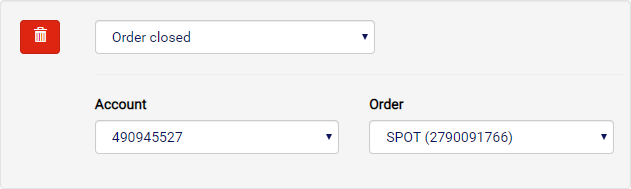

Delete This Alert will automatically delete the alert after it triggers. This is a good option if you have a one-time need, such as waiting for an order to fill.

Alert Conditions

Every alert must have at least one condition to evaluate. When there are multiple conditions, they must all be met for an alert to trigger at that time.

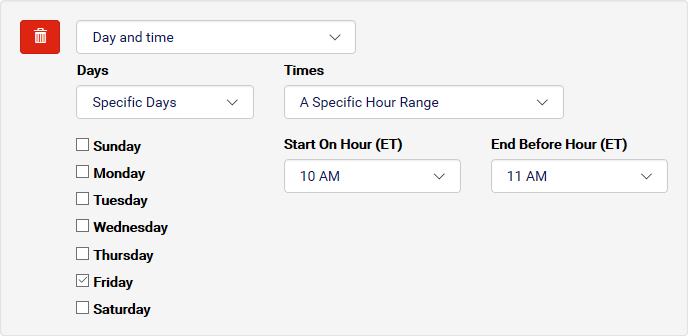

Day and time conditions are designed to scope alerts into specific timeframes. For example, you may only want option book alerts to raise during market hours. Or you might only want option assignment alerts to trigger 10-11AM on Fridays. Note that all times will be evaluated as current Eastern Time Zone times.

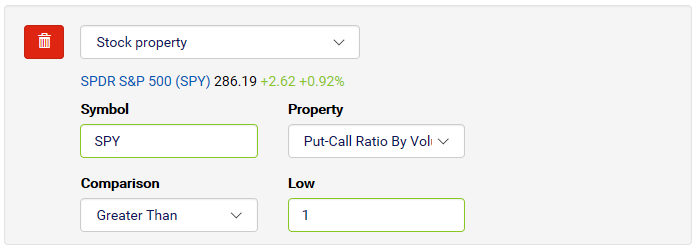

Stock property conditions watch for thresholds in stock properties, such as prices, implied volatility, and other key data points that are important to option investors.

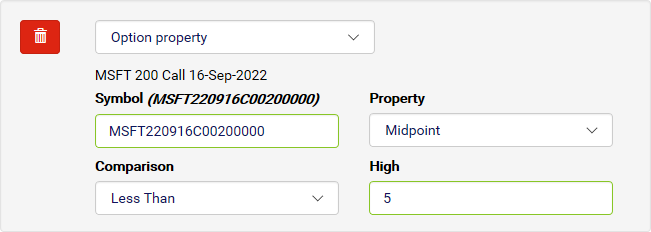

Option property conditions watch for thresholds in option properties, such as prices, Greeks, and assignment risk.

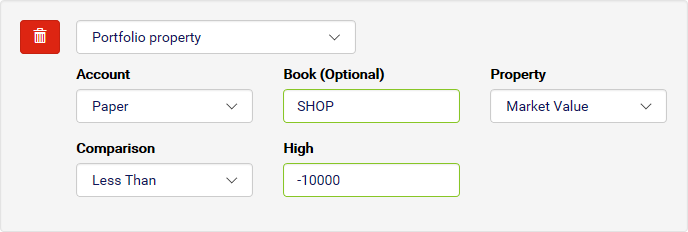

Portfolio property conditions watch for thresholds in portfolio properties, such as prices and Greeks. If you provide a specific book to watch for, then it will scope the tracking to just options in that book within the portfolio.

Option assignment conditions watch for assignment risks in the specified portfolio. You need to provide a Within Days of Expiration/Ex-Dividend parameter, which is the number of days to watch for an assignment event (expiration and/or ex-dividend). This is a maximum range parameter, so if you use “7”, then it will watch all options that are within 7 calendar days of expiration, as well as calls within 7 days of ex-dividend. The Risk of Assignment parameter is the minimum assignment risk that will trigger the alert. If you specify .3, then any options that meet the other criteria will need to have an assignment risk of 30% for the alert to trigger.

Portfolio event conditions watch for events important to the stocks in the specified portfolio. You can select the Type of event, such as upcoming earnings announcements or ex-dividend dates. The Within Days of Event specifies the window of days before upcoming events to check.

Order closed conditions watch for changes in the status of the specified order. More specifically, this condition watches for the order to be filled (including partially), cancelled, expired, or otherwise closed.

Want to see Quantcha Alerts in action? Check out our video on YouTube.

Try out Quantcha Alerts using our free hands-on training.

We’re always adding more conditions, so if you don’t see something you need, please reach out to us at hello@quantcha.com.