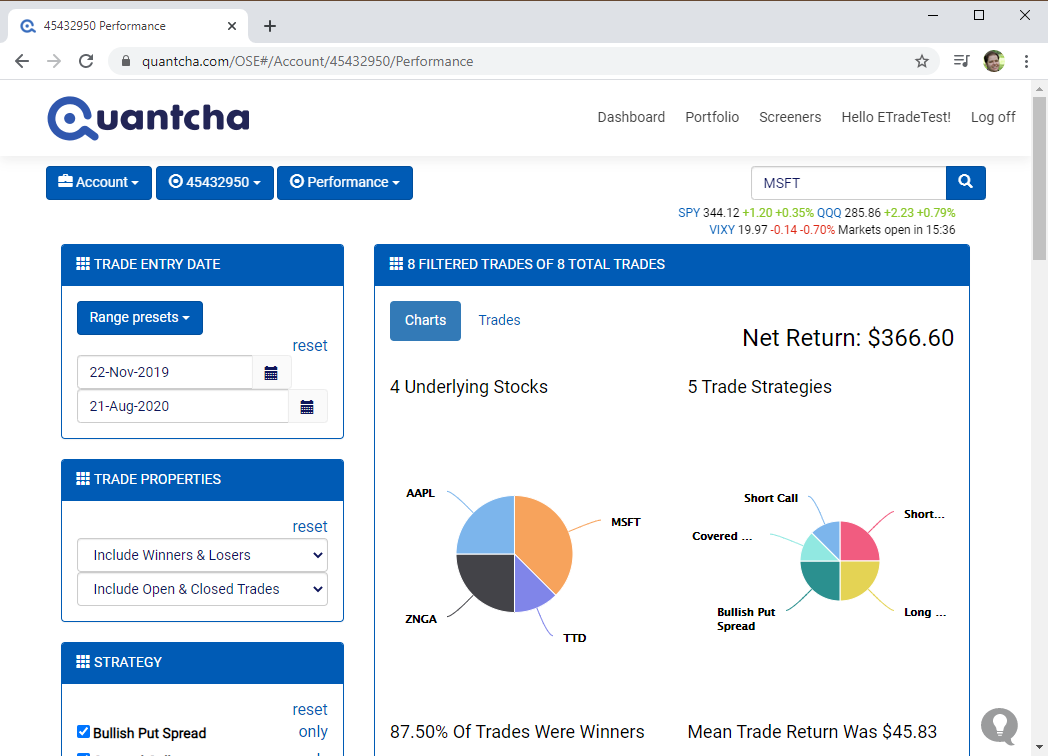

We’ve been proud to deliver top-quality tools and services to the option investment community for the past decade. However, in that time we’ve received tons of feedback that the entire industry wasn’t properly serving its membership with the tools it needs to effectively organize their various strategies.

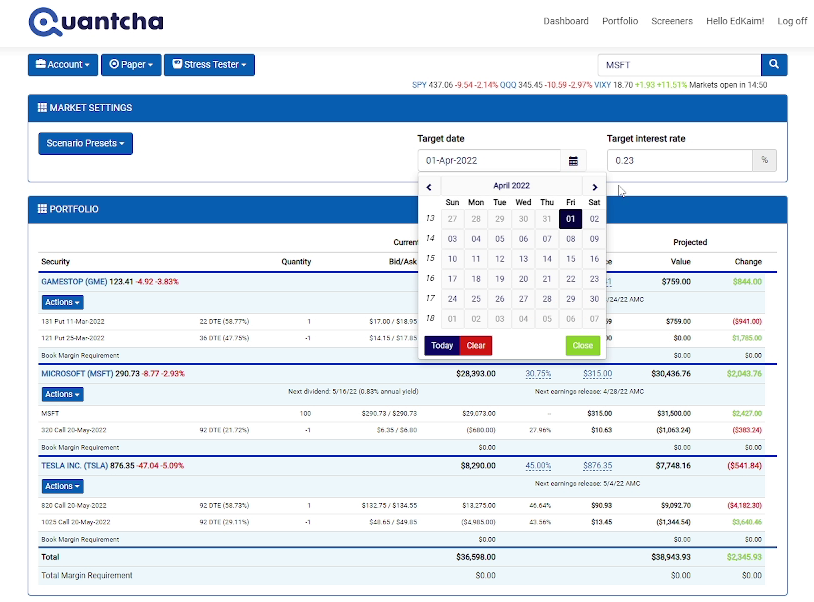

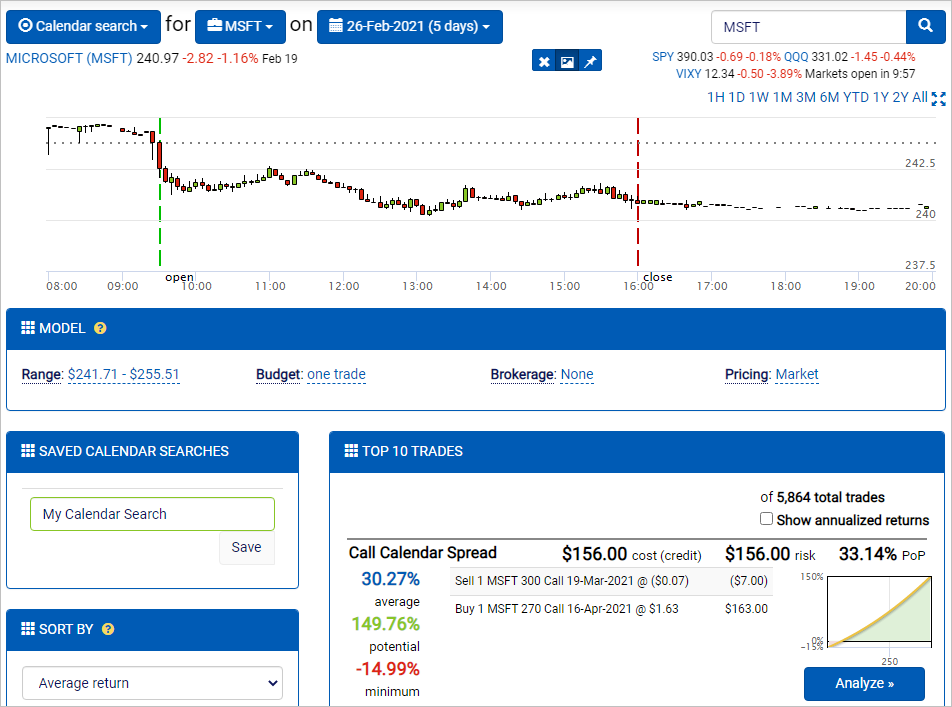

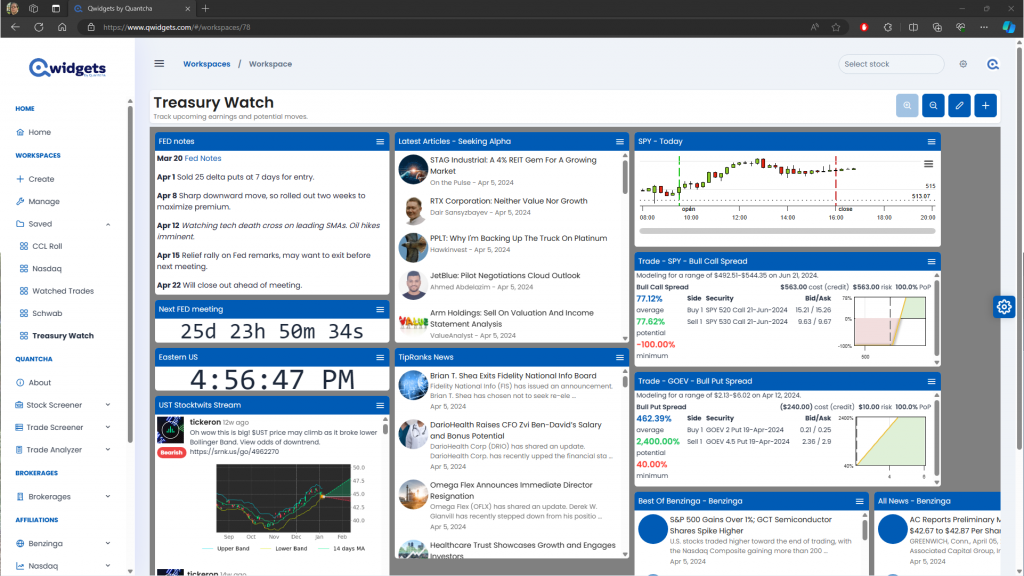

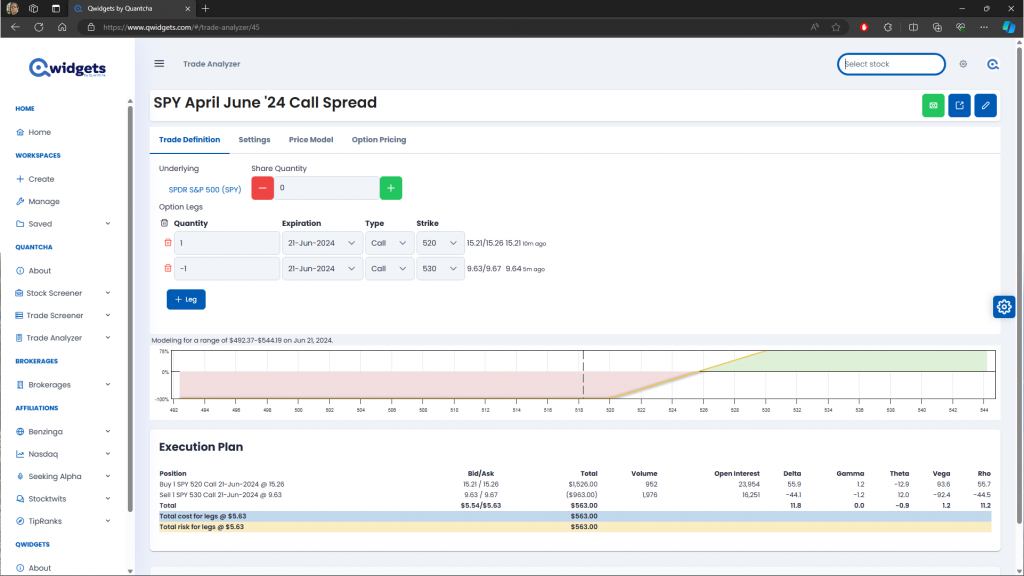

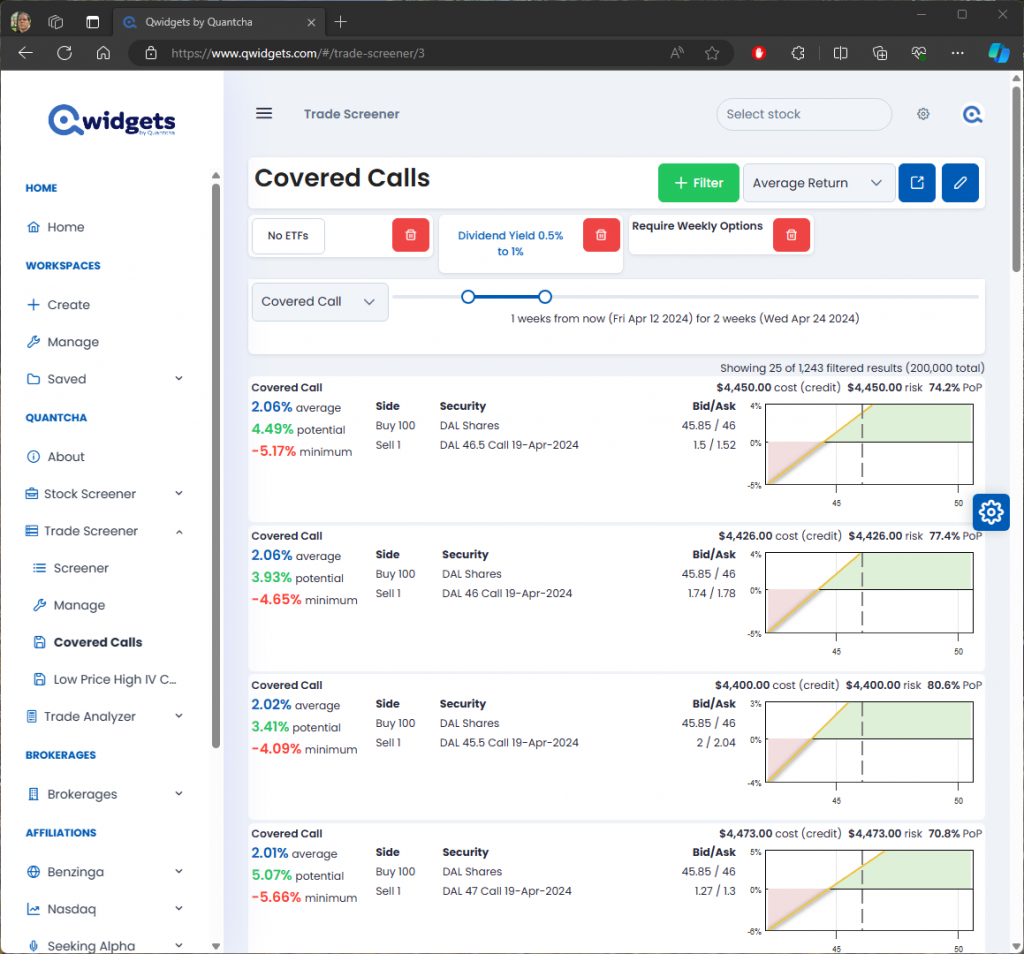

Around a year ago we set out on a journey to update Quantcha to provide tools to meet these needs. Our vision was to deliver a workspace-driven user experience where users would be able to precisely customize each workspace to fit their exact needs for the task at hand. This customization would come in the form of task-focused widgets designed to chart quotes, track trade ideas, manage orders, and so on. The scenarios were endless, so we knew it needed to be flexible.

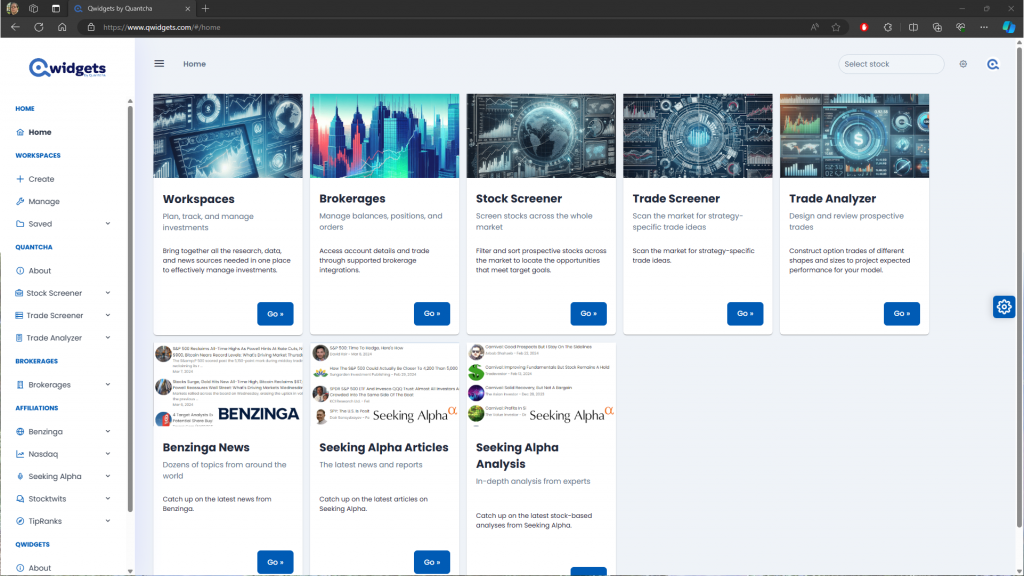

As we started showing our industry partners early demos of this new feature—which we were calling Quantcha Widgets—there was consistent feedback that it would be really helpful to a much broader audience than our traditional options investor customers. As a result, we made the decision to launch it as a separate service called Qwidgets and make it free for everyone.

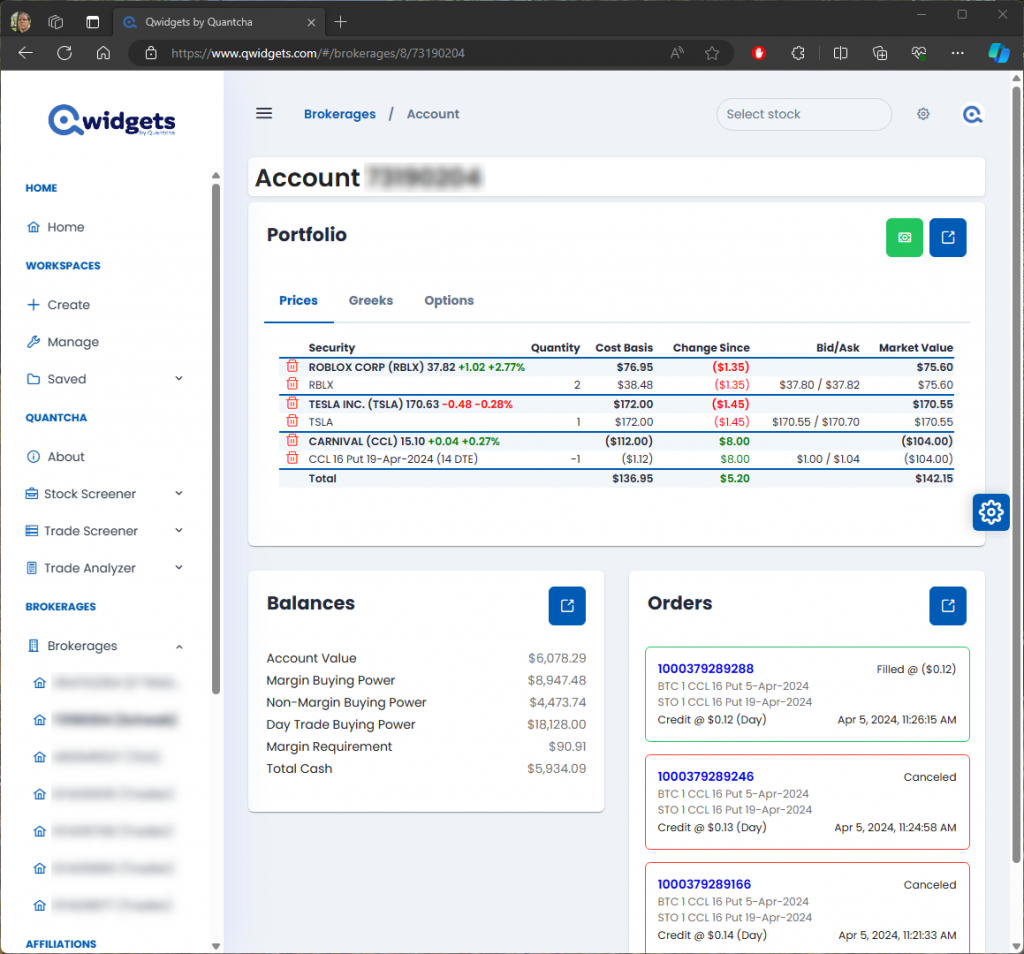

We also knew that users relied on a lot of data and functionality beyond what we delivered. To meet those needs, we partnered with some of the best names in finance to integrate brokerage, news, analysis, social media, and more. We envisioned a platform where anyone could place and manage orders alongside the latest research and breaking developments.

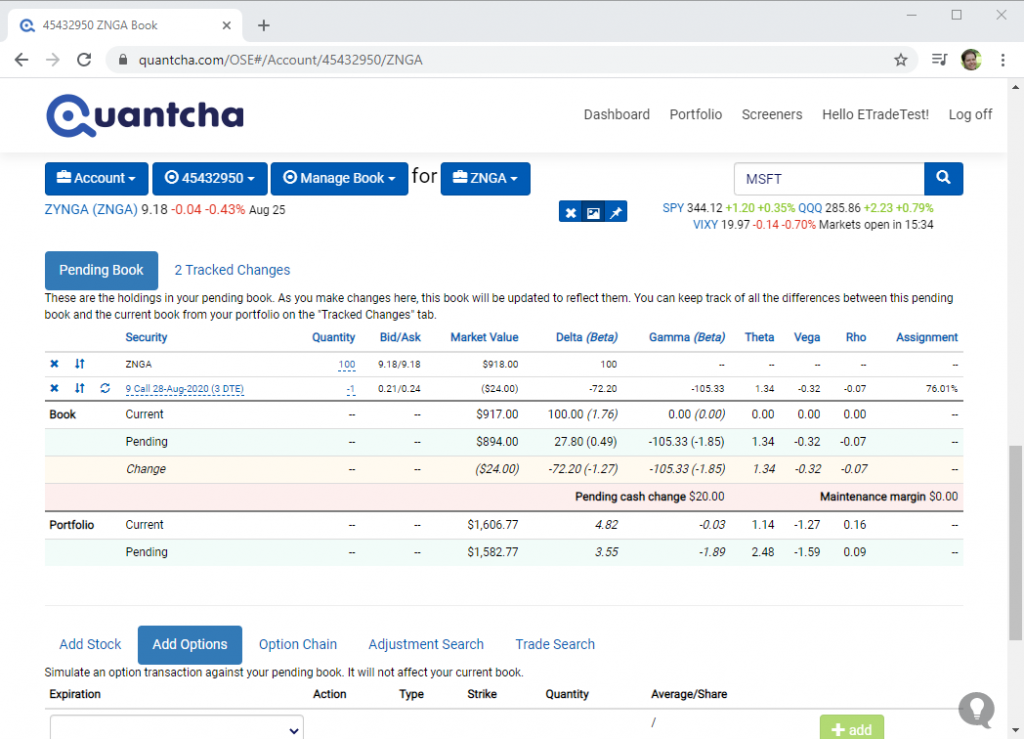

To use Qwidgets you’ll need to create a new account that’s separate from your Quantcha account. However, you can then link your Quantcha account in order to enable some advanced options-focused features, such as pages and widgets for screeners and the trade analyzer. Over time we’ll be migrating all of our Quantcha functionality to Qwidgets so that subscribers can enjoy the full depth of our functionality on either platform.

If you have feedback, please let us know at hello@quantcha.com. In the meantime, check out our launch video!