My name is Ed Kaim, and I’m the founder at Quantcha. We’ve been providing tools for active options investors for over four years now, and have put together a pretty compelling platform in our Quantcha Options Suite. I’d like to share one of my experiences in building Quantcha that has led up to a major announcement we’ve just made. It starts way back in the early days of 2016…

At the time, we had great tools for finding and optimizing option trades. Whether you had a specific view on a stock or were scanning the whole market for popular strategies, like covered calls, we had everything you needed to “turn your good idea about a stock into a great options trade”. It was even our tagline at the time.

However, I kept running into challenges with my own investing. I’m a firm believer that a company should eat its own dogfood (use its own products), so I was pushing Quantcha to its limits. The biggest issue I kept running into was “OK, I have a portfolio—what do I do next?”

There have always been tools that help you find trades, but there really weren’t any that helped you manage the holdings they produced. Sure, you could calculate a portfolio beta and look at the Greeks for a given options book (holding of shares and options for the same underlying), but those are just black and white dots in a 3D world. We wanted a lot more, and we knew other investors did, too. So we set out to build what would ultimately become our Options Book Manager. It’s a sophisticated set of functionality that’s focused purely on what option investors need to manage holdings they already have.

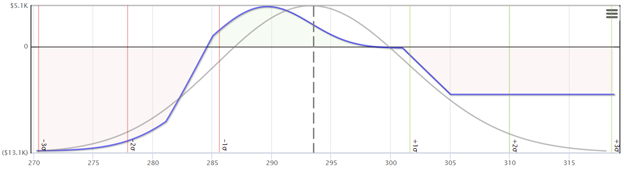

The book manager grew from humble beginnings. At first, we just wanted to be able to envision the profit and loss diagram for an arbitrary set of options on any date in the future.

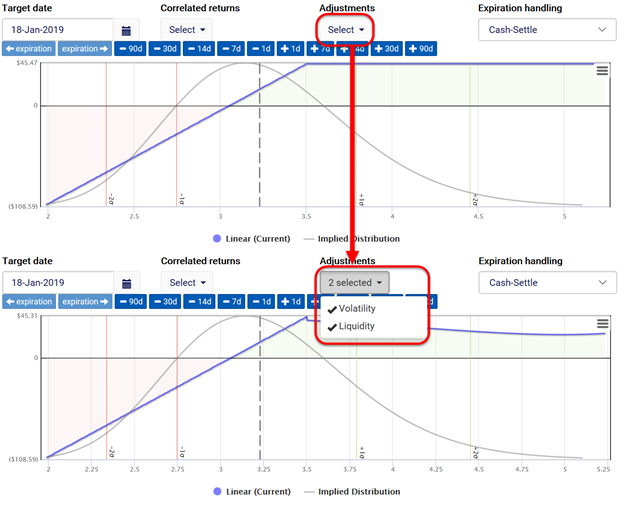

Unsurprisingly, this evolved into a complex undertaking as we began to expand features like crazy. We wanted to see the returns of books beyond the expiration of some of the options, and we wanted to be able to specify how those options were handled if they were in the money. When valuing options at future dates, we wanted to use sophisticated analysis to accurately infer the expected future implied volatility for any option in the chain on any date. We also wanted to do the same for liquidity to make sure we weren’t overpromising returns along the way.

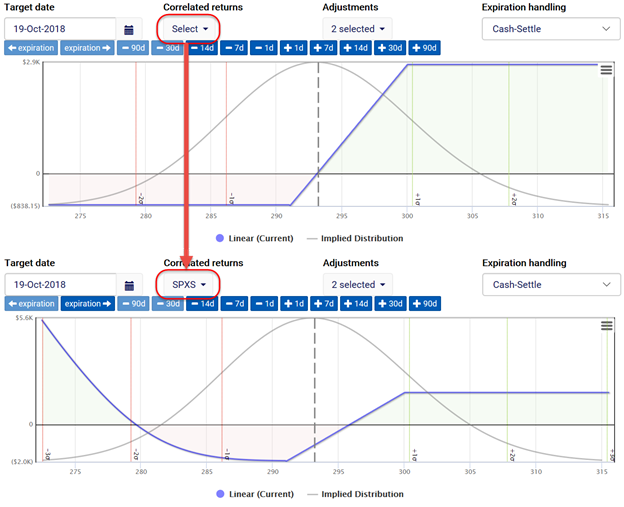

Perhaps our most ambitious task was implementing the “correlated returns” feature. The idea was simply that some investors would hedge one book using shares or options on another stock. For example, you might have an SPY book and buy SPXS (SPY 3x inverse) calls as part of a strategy to hedge it. We wanted investors to be able to model that scenario all at once to see how their combined holdings would perform relative to their target stock.

As the book manager evolved and immediately proved its usefulness, it actually opened more doors than it closed. Instead of being a glorious tool to project the future value of a book, it started looking and feeling like a much larger product that was missing some very important features. We had a great way to visualize the book, but were missing what we really needed—features to find, evaluate, and apply changes specific to that book.

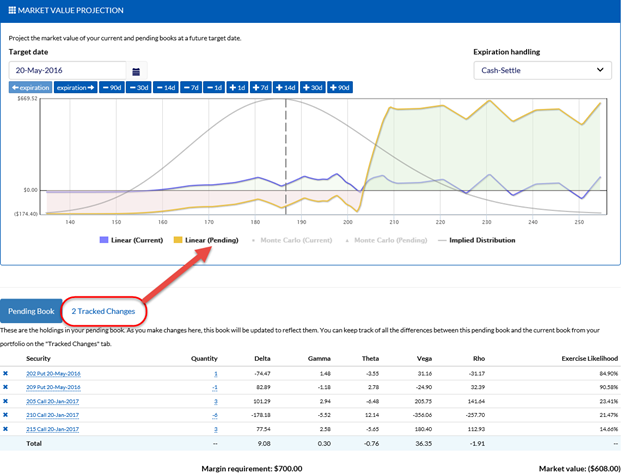

The first feature was obvious: we needed a way to visualize changes you were thinking about making. For example, if you were planning to roll a covered call, we needed to show the P&L for your current book, as well as the book you were changing to. This level of experimentation reached well beyond changing quantities since you could use any aspect of Quantcha to find a potential trade and add it to your “pending” book with a single click. As you added, removed, and tweaked option positions, we would track the net changes required for you to efficiently get to your goal book.

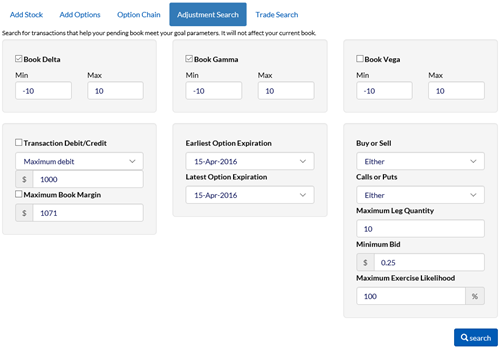

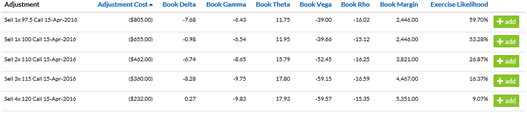

We also needed something to help investors find trades to meet their book goals. For example, many investors employ a “delta-neutral” strategy that is designed to protect their book from price changes in the underlying stock. They usually look to other Greeks for profit, such as vega or theta, and want to hedge out the risks associated with delta and gamma. While books can easily be delta-hedged with stock, it’s much less straightforward to hedge gamma and the other Greeks since you need to use options. For this, we developed an “adjustment search” that would scan the available options that meets an investor’s parameters to determine the best ways they can balance their book to fit specified criteria. Want to sell puts expiring 8-10 weeks out that are less than 25% likely to get assigned and give your book a net delta and gamma in the +/- 10 range? If it’s possible, we’ll find it.

As all of this design and development is going on, I was constantly dogfooding our latest bits to find bugs and produce new ideas. It also gave me an opportunity to implement a delta-neutral strategy, which was something I had never done before. To be honest, I was a little afraid of range-bound trades like condors and butterflies because of the substantial risk in either direction. But I had to—it was my job.

The delta-neutral strategy was simple: every Monday and Friday I would add an $SPY iron condor position expiring about 3 weeks out and then hold it through expiration, closing positions as necessary to avoid exercise. The trades would be selected from our options search using the “neutral” view and configured so that they would profit if the underlying closed within a 1-volatility movement at expiration. I would also hedge using single-leg trades in order to keep delta and gamma in check. This might sound a bit complicated, but the net takeaway was that I would be adding 4-5 new options to the $SPY book every 3-4 days.

By the time I entered my fourth week, my $SPY book contained varying quantities of 33 separate $SPY options across five expiration terms. There is no way I would have been confident managing such a monster using Greeks alone, but our book management tools were just awesome. This dogfood approach also helped us improve them in some clever ways that really delivered what was needed for this kind of sophisticated book.

The S&P was pretty tame in the first half of 2016, so this kind of strategy was just printing money. The only problem was that I was losing a lot of it to commissions. The brokerage I was using had a structure of ~$8/trade and ~.75/contract, so a typical condor trade of 50 contracts per leg (200 total contracts) cost over $150 in commissions alone. There were months where I spent over $1200 on commissions for just this book. I was still turning a healthy profit, but that leakage was a consistent thorn in my side.

As time went on, the market opportunity for this strategy started to wither, and there were bad periods. Even with proper hedging, a strategy like this is going to struggle when the stock is consistently surging while volatility fades. But as my profits started turning to losses, one thing remained—I was still paying a ton in commissions. At one point I realized that my typical trade was leaking ~3% of its profit potential to commissions. I didn’t pay much attention to this when we were using this strategy as a real-world test harness for our platform, but I had continued to employ it for my personal gain well after we had launched. All of a sudden those commission costs mattered—it was MY money, and I didn’t feel the reward was worth the risk after you backed out commissions. The problem was even more pronounced when you considered trading with a smaller budget. Trading this iron condor strategy with single-contract legs would leak around 15% of your profit potential to commissions. This was a heavy realization that these substantial costs would be a deal-breaker for most retail investors considering the scenarios our tools unlocked.

Well, we finally did something about it. We could no longer let commissions eat at our customers every month. I’m excited to announce that Quantcha is now offering an Unlimited tier for $99. With this plan, you not only get full access to everything we offer in the Quantcha Options Suite, but also unlimited commission-free trading of stocks and options. You can learn more about this offer at https://quantcha.com/UnlimitedCommissionFreeOptionsTrading.

The underlying brokerage services are provided by Tradier Brokerage, a member of FINRA/SIPC. We’ve worked with them for over four years now and firmly believe that this is the best path to enable our customers to cap their monthly commission expenses and leverage the robust cloud execution technology of Tradier. Tradier Brokerage will pass along exchange and regulatory fees, just like every other broker, but will not charge you any per-trade commissions. This should remove the final barrier for any options investor to scale their trading and book strategies in a way that unlocks the full potential of our book management capabilities. We’re also deeply integrated with their API, so you don’t need to leave Quantcha to manage your trades and portfolios, and you get real-time quotes from within our tools.

We’ve also put together a pretty sweet deal for investors who are new to options and not quite ready for the commission-free commitment. Every month you trade at least 15 times from your Tradier account, they’ll pay for your Quantcha subscription. You can learn more about that offer at https://quantcha.com/GetQuantchaForFree.

As always, good luck, and good hunting.