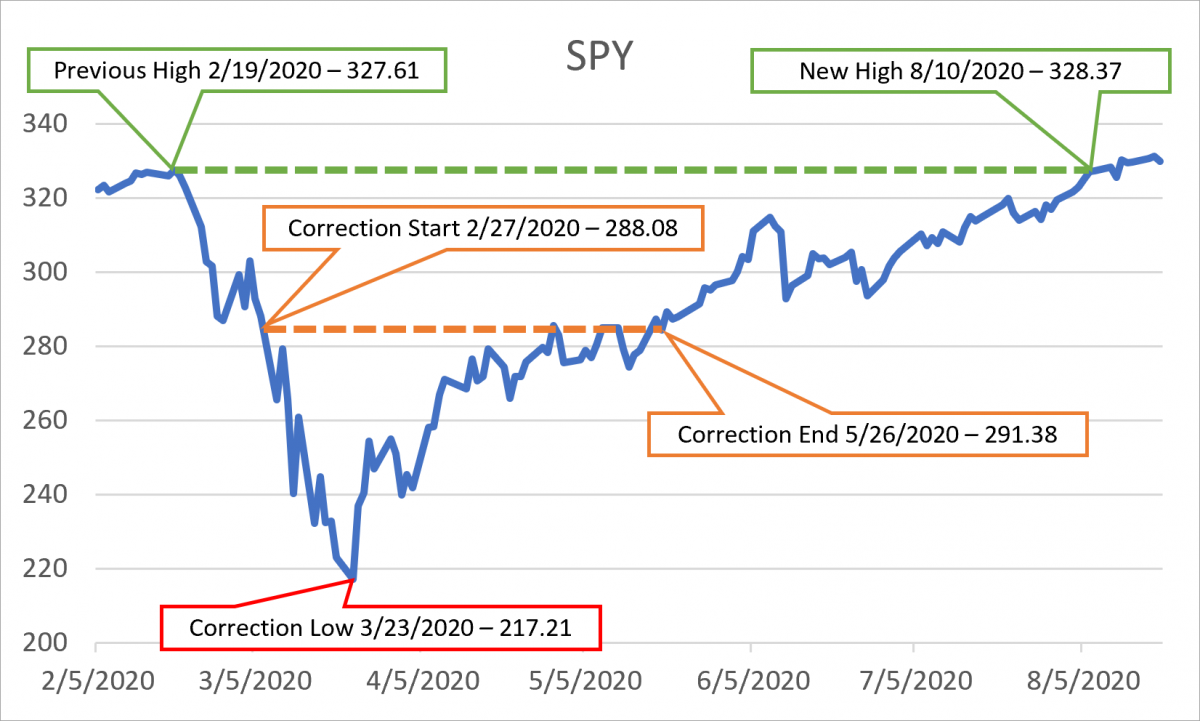

We’re proud to announce that our latest research report, What do we know about market corrections?, is now available. This report analyzes market correction cycles as indicated by a 10%+ drop in the S&P 500.

The report focuses on answering common questions about market corrections, including:

- How often do corrections happen?

- How long does it take to enter a correction from a high?

- What can we expect once we enter a correction?

- How does the market perform during a correction?

- Is it worth trying to call a bottom?

- How long does it take to recover from the bottom?

- What happens after corrections?

- What can we do with the data we have?

- What happens if you invest at the start of a bull run?

- How do we know when a correction is coming?

- How do we know when a correction is easing?

- What kind of returns can we expect from different correction milestones?

- Is there an ideal strategy for correction investing?

It also includes details on how anyone can gain special insights regarding correction progress via option-centric data.

The report is also available as a PDF for download.