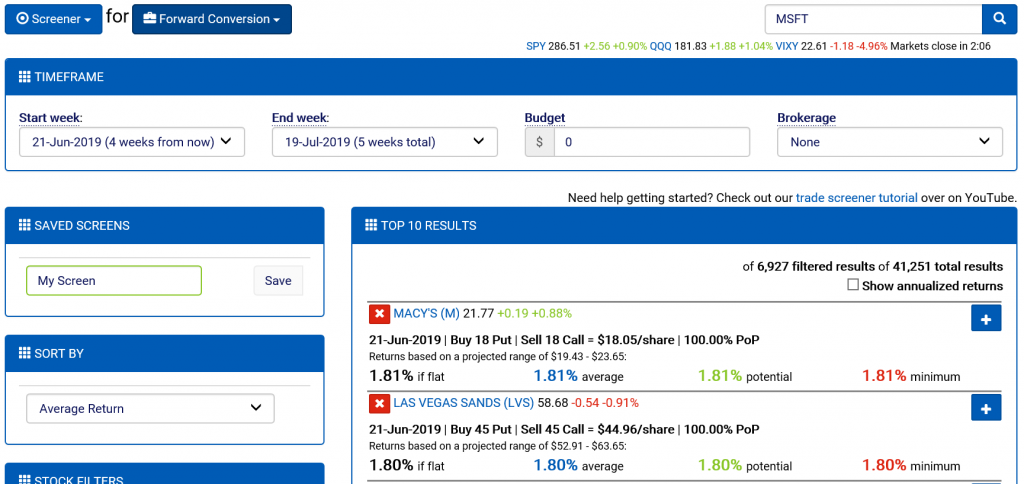

We’re proud to announce the launch of six new global trade screeners, as well as a variety of updated features that enable investors to find more efficient ways to play their market views.

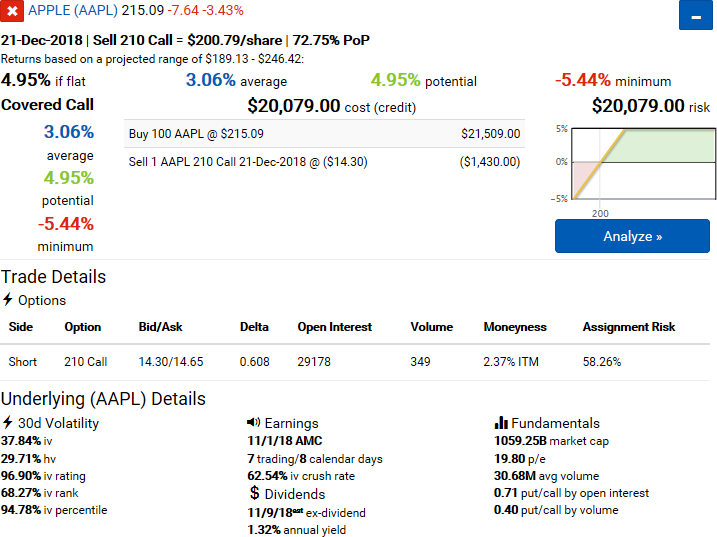

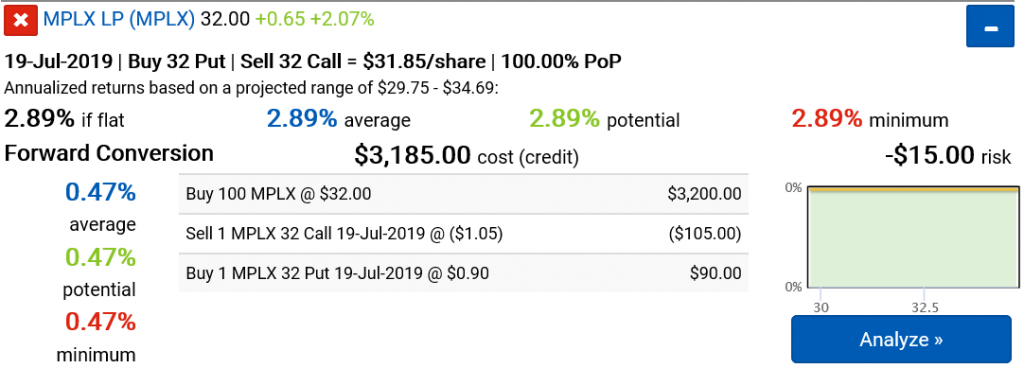

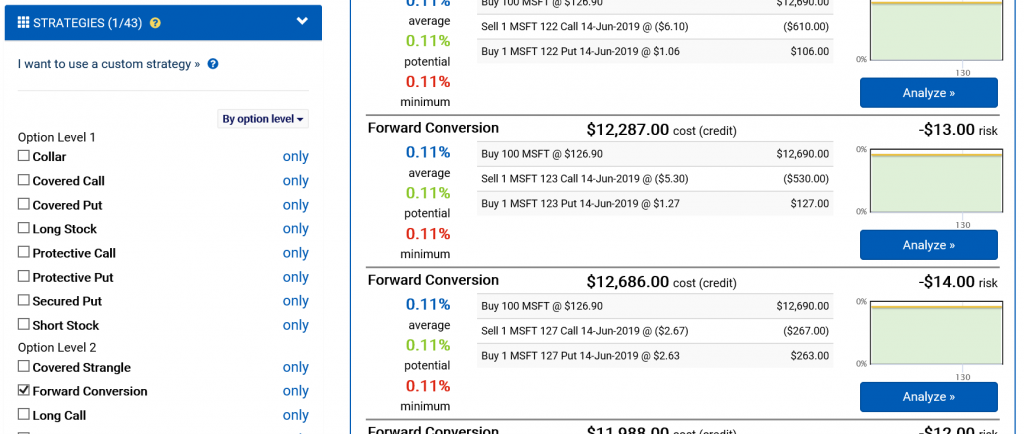

Among our new trade screeners are two focusing on finding conversion arbitrage opportunities. The Forward Conversion screener pairs long stock positions with synthetic short stock positions created using options. The net result is a delta-gamma-neutral strategy with a defined return. You can learn more about our arbitrage discovery features here.

There is also a Reverse Conversion screener, which is the inverse of the forward conversion strategy. These two strategies have also been added to the option search engine so that you can easily zero in on opportunities for specific stocks and expirations.

Trade screeners for common credit and debit spreads for calls and puts have also been added. Check out the new screeners for Bull Call Spreads, Bear Call Spreads, Bull Put Spreads, and Bear Put Spreads. All screeners rely on the same user interface framework, so experience with one makes you an expert on using the stock screener or any of the nineteen trade screeners. You can learn more about using our screeners here.

These features were largely driven by community demand and requests provided via our UserVoice and feedback email. If you have ideas you’d like to see us implement, please let us know.