Ready to get started trading earnings with options? Check out Quantcha’s top 10 features for you!

The post-earnings IV crush is a well-understood fact, but the opportunities to profit from it aren’t as straightforward as they might seem.

You know it’s there. Like gold in a mountain, the opportunity to sell volatility going in to an earnings announcement is an irresistible siren’s call for so many options investors. There are infinite ways to trade it, and our tools provide what you need to craft and manage any strategy. But we’re not going to focus on how you “should” trade IV crush. Instead, we’re going to talk about the unsung hero of our earnings arsenal: the proprietary Quantcha Earnings Crush Rate™.

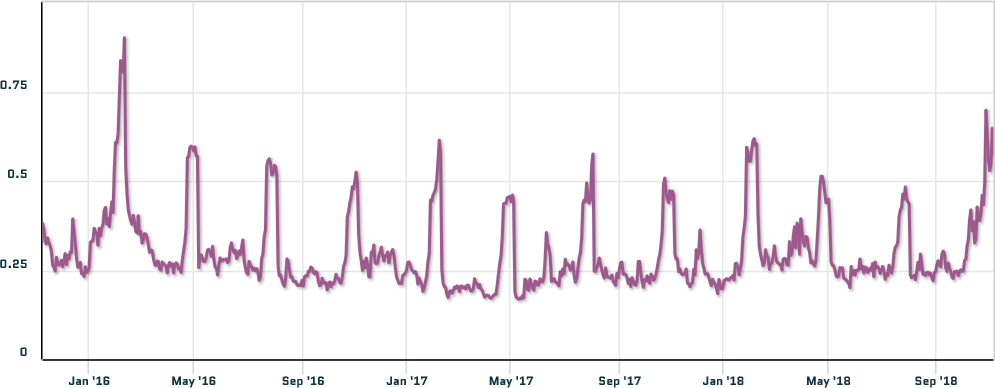

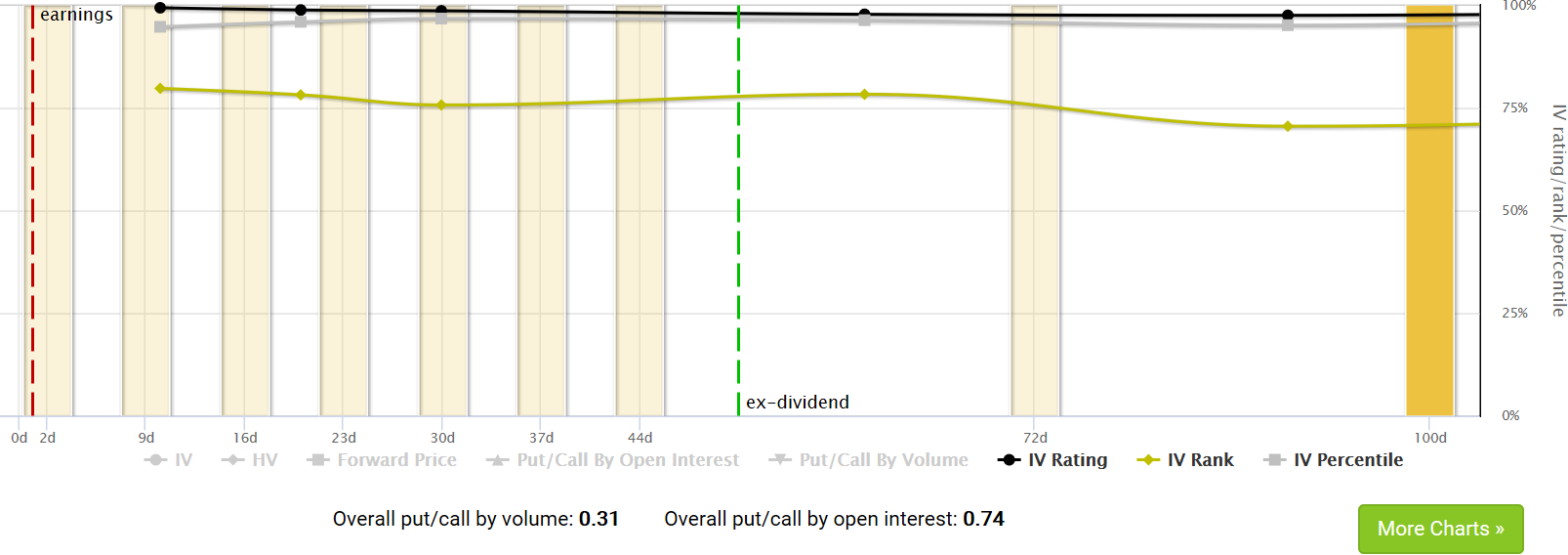

It all starts off with a misconception about selling volatility. There are a lot of services and advisories out there who love to promote the potential of selling when IV valuation (IV Rating/IV Rank/IV Percentile) is high. And they’re right—usually. Since there’s a market bias toward buying options, IV tends to be higher than the eventual realized volatility of the term they represent. A well-timed strategy of selling volatility when the current IV is higher than usual for the underlying can produce profits.

The problem is that IV is always elevated going into earnings because of the uncertainty. As a result, you’ll always see a high IV valuation for every stock leading into their announcement. However, that doesn’t necessarily mean the valuation is rich. The industry’s steady diet of “sell options when IV is high” guidance has the effect of driving down option prices (and therefore IV) since so many investors are more than willing to take on what they assume is overpriced risk at earnings.

The question of whether you should buy or sell IV going into earnings comes down to whether or not you believe the IV is richer or cheaper than it should be. Super helpful, right? No, of course not. But stick with us here.

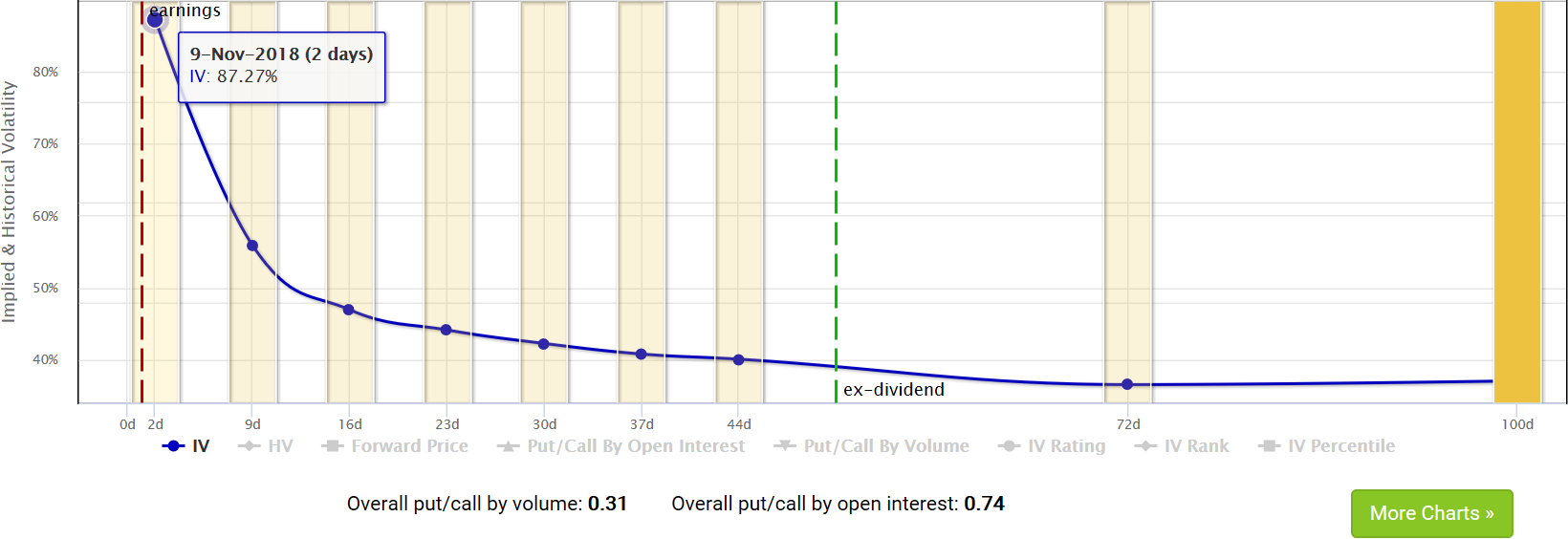

Shorter-dated options are the most sensitive to earnings volatility, and longer-dated options have the least sensitivity. In other words, the options expiring over a year from now will have a much lower IV than the weeklies expiring immediately after earnings. The conventional wisdom is also that the longer-dated IVs represent the range all option series should settle around once the earnings uncertainty has cleared.

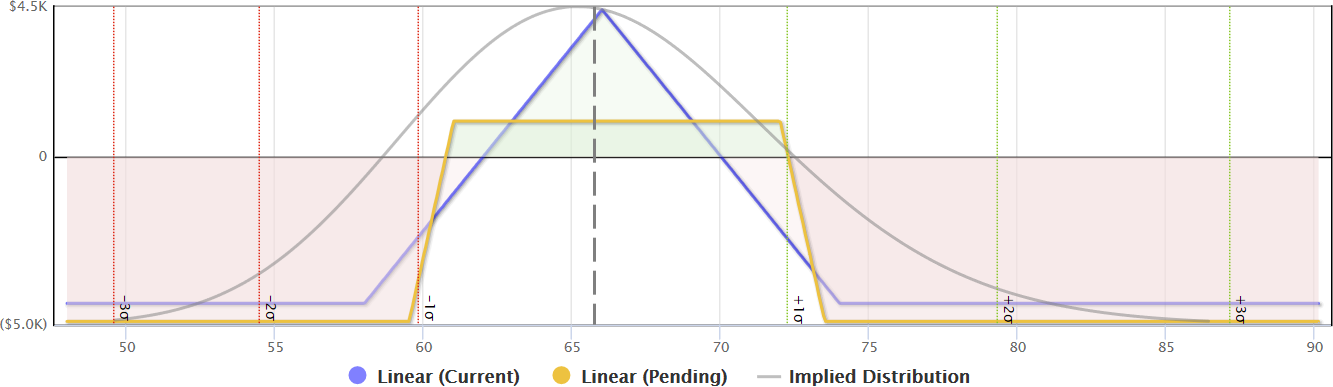

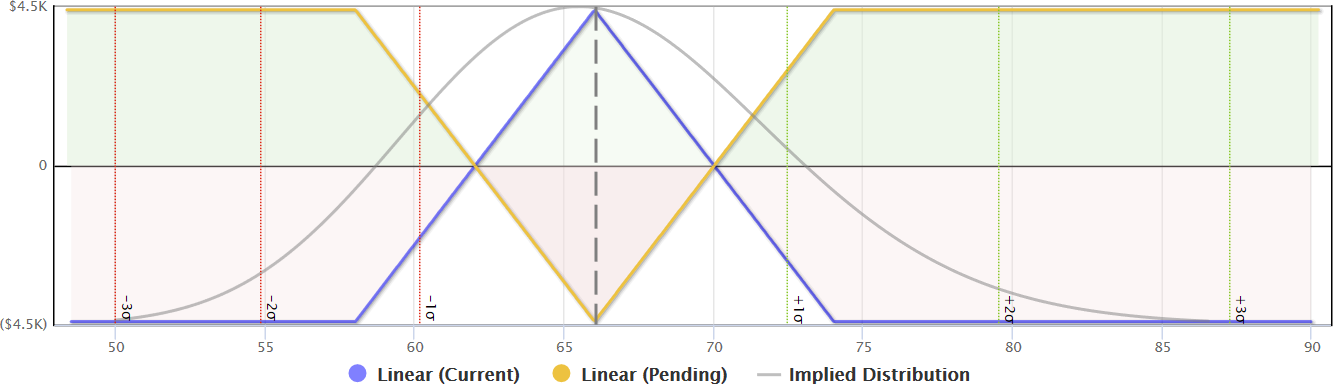

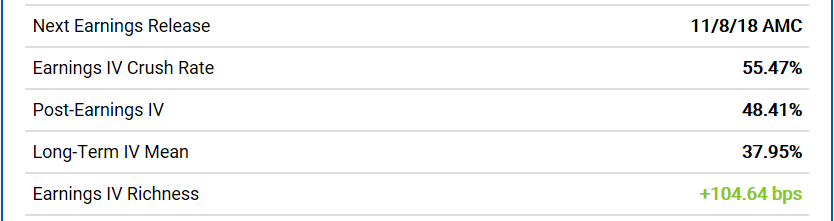

For example, suppose $ATVI is announcing this week, and the weekly IV is 87%. Their long-term IVs average around 38%, so the expectation is that IV across the board should settle in somewhere around there once the earnings are cleared up. That implies that these weeklies should retain about 38 / 87 = 44% of their IV.

However, it doesn’t usually work out that way since those shorter options generally stay higher than that long-term IV after the announcement. There are a variety of reasons for this, including the very short amount of time remaining and the continued volatility expected as traders factor in the earnings results. If you sell the weekly IV expecting that crush, and it doesn’t drop to that level, you won’t get the results you’re expecting.

How do you know what to really expect from those options? This is where our Earnings Crush Rate™ comes in. We use some sophisticated modeling techniques to derive the IV crush priced in for the expiration immediately following the announcement. This single metric indicates what the market pricing is implying the at-the-money IV to trade at immediately after the uncertainty has cleared. In the case of $ATVI, this rating is 55%, which means that investors are trading the risk as though the weekly IV will drop to 48%.

This is where the true IV crush opportunity lies. Based on this data, the weekly earnings IV is trading to crush to a level over 10 points higher than the long-term IV. If you feel that this is too rich because you expect the weekly IV to drop lower (or stay higher) after the announcement, then you can construct a strategy to isolate the profit opportunity.

To learn more about the earnings crush rate, please check out the video on YouTube:

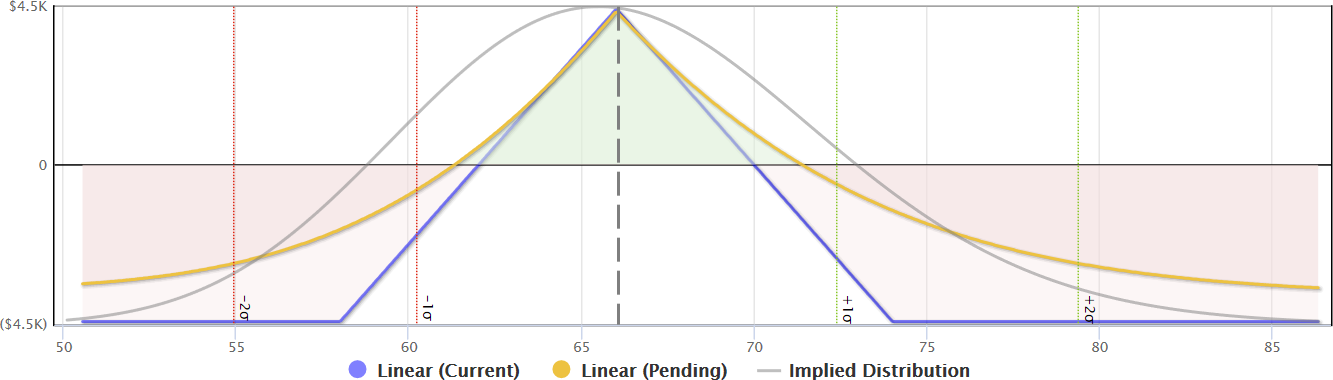

This leads into a discussion of another topic: how do you isolate volatility in an options trade? That’s beyond the scope of this discussion, but always keep in mind the risk that many delta-neutral trades expose you to. There’s a subtle different between trading volatility and trading “it can’t possibly move that much” sentiment. Stay tuned for a follow-up article on that topic.

Ready to get started trading earnings with options? Check out Quantcha’s top 10 features for you!