We’re proud to announce that our latest research report, An analysis of trading earnings releases using options, is now available. This report analyzes the behavior of options and implied volatility before and after earnings announcements.

The report focuses on answering common questions about trading earnings with options, including:

- Why trade options around earnings?

- How are earnings options priced?

- What about trading earnings directionally with options?

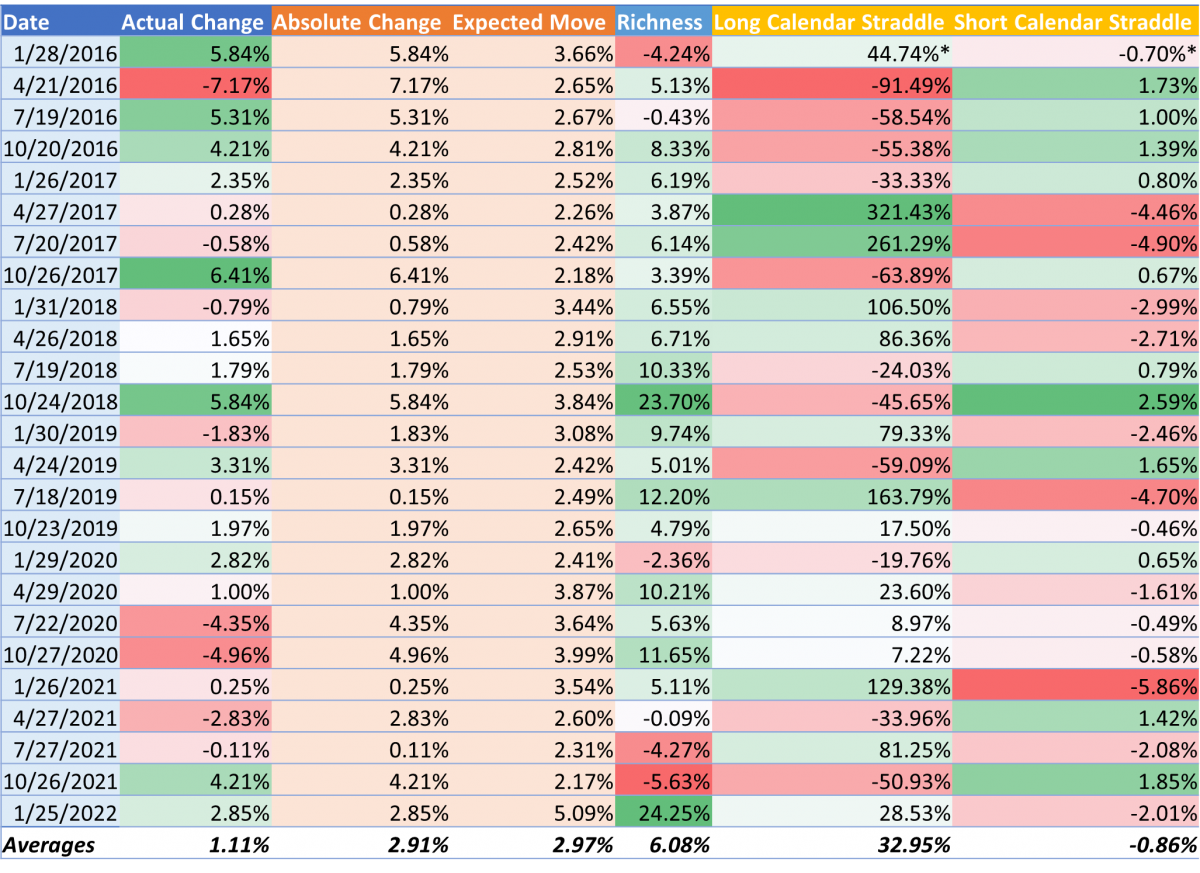

- How do we compare returns of long and short strategies?

- How important is option liquidity?

- What is implied volatility crush (IV crush)?

- What is earnings IV crush?

- How much does IV crush after earnings?

- Can we predict the earnings IV crush?

- Can we infer anything from the volatility surface?

- Can we still lose by selling overpriced IV?

- How can we hedge against directional moves?

- How do calendar trades hedge out directional risk?

- How can we employ calendar trades to capitalize on IV crush?

- How does this analysis hold up across the broader market?

It also includes details on how anyone can gain special insights regarding trading options around earnings via option-centric data.

The report is also available as a PDF for download.