Quantcha provides great tools for finding, optimizing, and analyzing option trades. Most of these tools, like the options search engine and trade analyzer, focus on trades where all option legs use the same expiration date. This enables a comprehensive analysis of at-expiration scenarios that are easy to understand.

However, there is a whole world of options trading that exists across expiration dates. These trades, generally referred to as calendar spreads, involve options that expire at two or more dates. These trades usually involve buying a certain type (like a call) at one expiration and selling another of the same type to offset it at a different expiration.

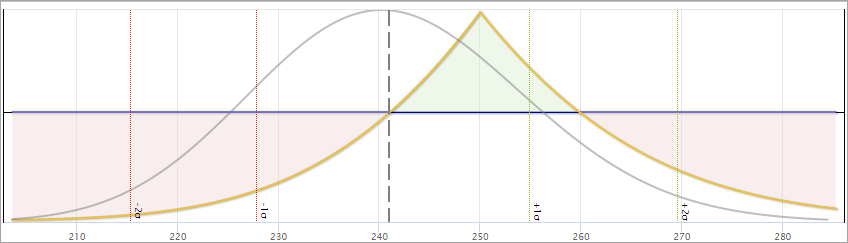

When these options use the same strike, it’s also known as a horizontal spread. If the strikes are different, the trade may be called a diagonal spread. Analysis of these trades is a bit more complicated because there is no single date that can be selected where the outcome of all legs is provable.

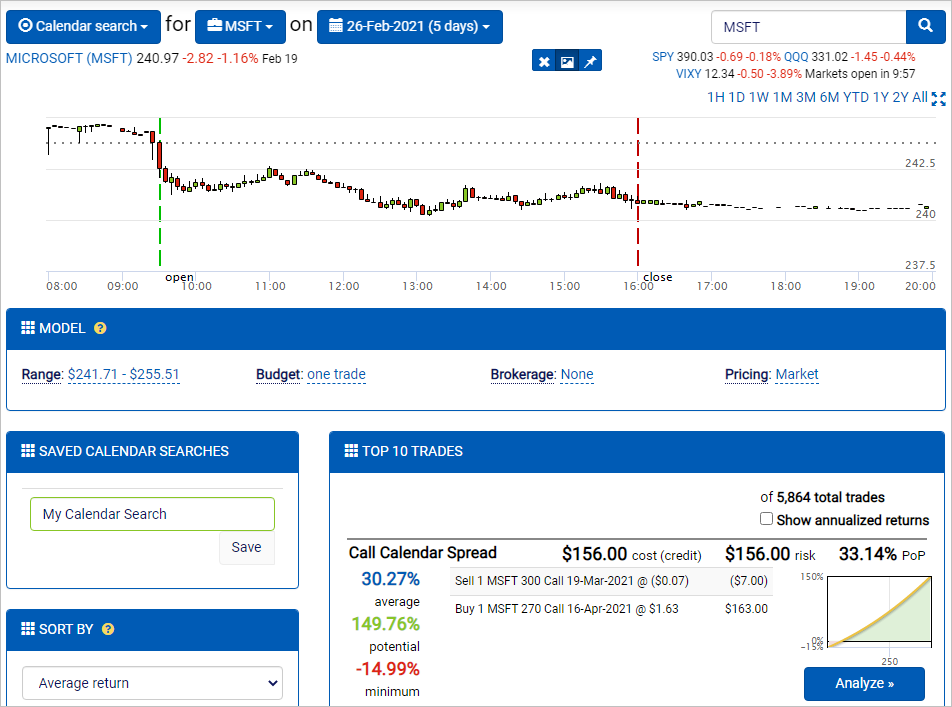

Fortunately, Quantcha has a great solution for these kinds of trades: the calendar search. This feature works in a way that’s very similar to the options search engine, but is optimized for locating precisely-defined calendar spread parameters.

Check out a video walkthrough of the calendar search on YouTube.

Tuning up in the book manager

Like the options search engine, the calendar search feeds trades into the trade analyzer, which leads to the book manager (or a trade ticket). The book manager offers complete flexibility when it comes to working with any set of options. It’s the ideal way to plan, optimize, and manage calendar trades. Not only can you visualize the expected return of calendar trades across expirations, but you can also tweak the option pricing parameters and trading behavior (IV, interest rates, expiration handling) that are used to evaluate your holdings at arbitrary dates in the future.

For free hands-on training with the book manager, check out Managing option holdings with the book manager.

What about screeners?

We get a lot of requests to add screeners for calendar trades. Unfortunately, this just isn’t a feasible option for the foreseeable future.

Part of the issue has to do with the sheer number of potential calendar trades there are. Considering ~500K calls trade on the market at any given time, there are ~500K covered call trades to consider, most of which are not interesting opportunities. If you want to screen for calendar call spreads, the number of prospective trades would be 500K squared, or about 250 billion. It continues to grow exponentially when you add in a third or fourth leg.

Another challenge has to do with the evaluation date of the trade. When all legs expire on the same date, you can use that date to build an analysis to compare with other trades. There isn’t a clear date option that works for calendar trades since some might have weeks between expirations while others have months. There are also decisions that would have to be made consistently across all trades when determining how to handle option pricing parameters for legs that are still in play.

A unique challenge to Quantcha’s screeners are that we evaluate all trades based on an implied range specifically tailored to each underlying at each expiration for each strategy. This is a far superior approach relative to one where the return is simply assumed to be a specific price in the future. The downside is that it requires more planning and consideration.

All of this makes calendar trade evaluation more complicated because different investors may have different intentions for the same trade. Some may want to hold a long LEAP option and sell shorter-dated options against it to reduce the cost basis. Another might want to sell short-term premium that is hedged by a longer-dated LEAP. Even though they could end up using the same exact trade, the investors will be looking for different analyses based on their anticipated movement.

Identifying calendar trades with Quantcha

If trading two-legged calendar spreads, the easiest way is to use the calendar search described above. It offers the best combination of speed and flexibility for locating promising opportunities.

Another approach is to use one of the many platform tools to identify individual options to build calendar trades leg by leg. As you identify legs that meet your criteria, you can add them to the book manager for further review and adjustment. The book manager also includes a very helpful Roll feature that simplifies the process of replacing one option with another when adjusting the legs of a book or prospective trade.

When planning a four-legged horizontal trade, such as a calendar straddle, the options search engine is your most efficient path. Just break down the trade into its two term components and find them independently. Once you find one trade, such as the near-term straddle, send it to the book manager. Then return to the options search to find the far-term straddle and repeat the process to send it to the book manager. Both trades will be combined into a single calendar trade that you can analyze in depth and optimize further, if necessary.

Quick tip: the trade analyzer offers an “invert trade” button that will invert the side of each leg (long to short and vice versa). You can use this along with the breadcrumb expiration dropdown to quickly identify the inverse trades for scenarios where your calendar trades are hedged with options at the same strikes.

When in doubt, don’t forget that the book manager offers absolute flexibility for modeling trades. You can add any arbitrary number of legs and quantities to craft trades of any shape and size.

Interested in a real world example of using Quantcha to set up a calendar straddle to trade earnings? Check out this video from The Quantcha Challenge.