Option investors have an incredibly broad range of strategies at their disposal. Whether using options to hedge an equity position, implement leveraged plays on directional views, capture volatility opportunities, or virtually anything else, there’s a lot that can go right. And wrong. Understanding what’s likely to happen in the worst-case scenario helps investors plan for—and survive—the doomsday scenario.

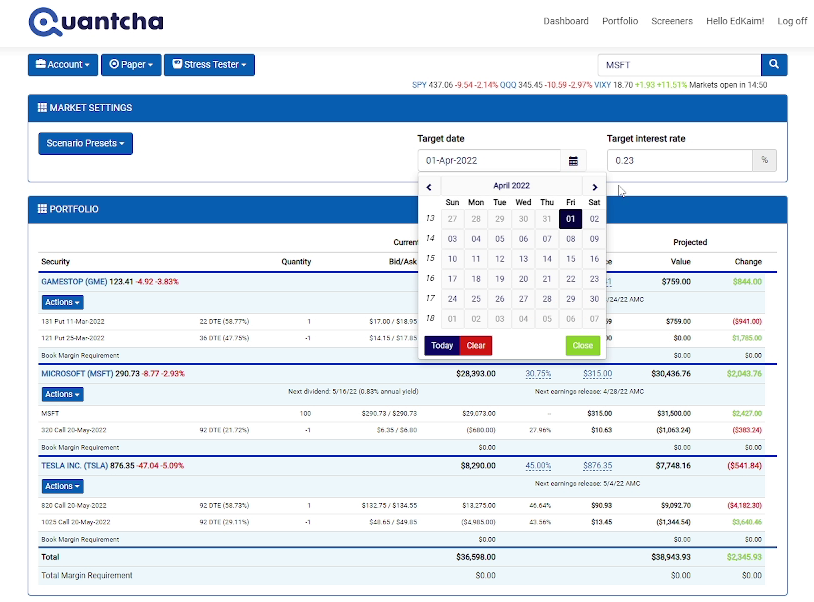

This is where Quantcha’s stress tester comes in. It provides an easy and flexible way for investors to experiment with different settings to project the market value of their portfolio at a future date. With this data in hand, better informed decisions can be made for hedging out these risks.

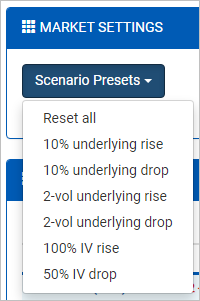

It’s easy to use. It automatically imports your portfolio, so there’s no need to do any special work to set it up. Settings can be easily adjusted using presets or custom values, and the results are simple to understand. It even calculates the expected change in margin requirements for portfolios with naked positions.

It’s flexible. Every portfolio is going to have its own weaknesses, so it’s important to be able to customize the model to meet exact needs. The stress tester allows adjustment of global market settings, like the risk-free interest rate, as well as underlying settings, like the implied volatility and price for each stock.

It’s powerful. It uses smart defaults to initialize the scenarios with feasible volatilities derived from the implied volatility surface for the underlying. Future IVs for each option are modeled relative to the target change in the underlying spot IV so that users don’t have to try and guess the right option IV values to use when pricing option positions that are still open on the target date.

Want to see the stress tester in action? Check out our video on YouTube. We’re always adding more presets, visualizations, and other features, so if you don’t see something you need, please reach out to us at hello@quantcha.com.