Managing risk and generating additional reward are a lot harder than they sound.

That’s why Quantcha provides a variety of features that do the heavy lifting for you. Whether you’re trying to figure out the optimal option to roll a covered call to or balancing a delta-gamma-neutral book, the options book manager provides the tools you need to feel confident in your next move.

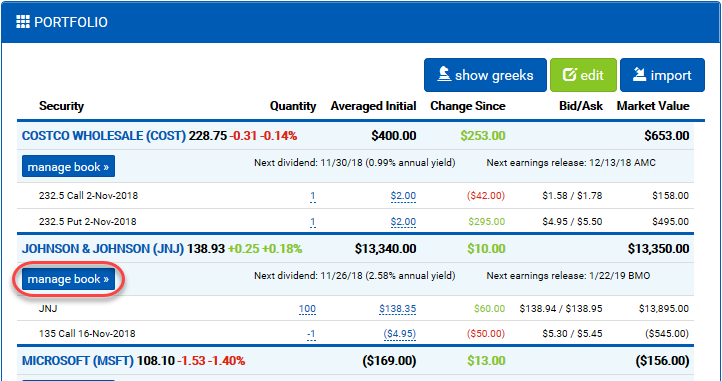

There are a lot of ways you can manage your book for a given stock. The easiest is to click the manage book button in your portfolio view.

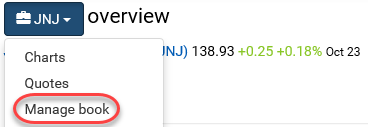

Alternatively, you can always select the Manage book option from a stock ticker dropdown at the top of the screen.

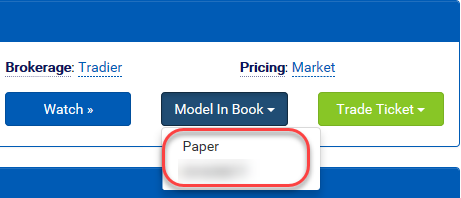

You can also send a trade you’re analyzing to the book manager. This helps you see how it impacts your current holdings and any other pending changes you’re considering. Note that each account you have linked has its own set of books for each underlying you hold. Everyone also has a “paper” account to work against, and you can automatically pull in your brokerage portfolios if you link your account.

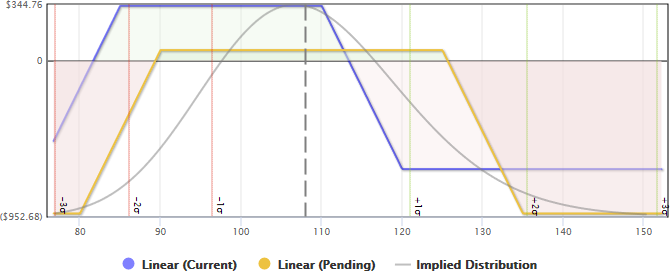

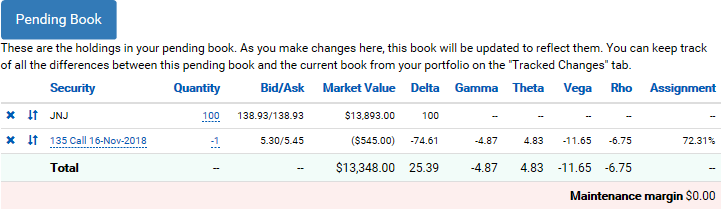

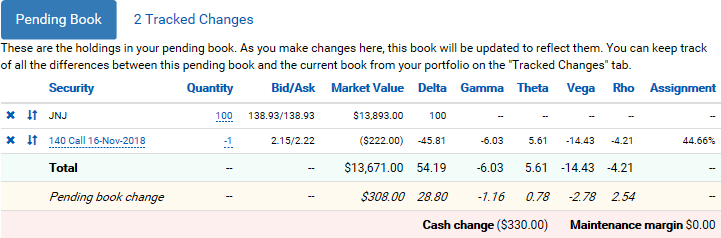

In the book manager, you’ll get a flat view of your holdings for a given underlying. It includes current pricing, Greeks, and assignment risk (likelihood of exercise before or at expiration). If you’re simply hedging with stock, the total delta gives you the number of shares to trade. However, you may want to add, remove, or adjust positions, which is where the book manager really shines. It tracks two separate books: your current holdings and your “pending” holdings.

As you experiment with changes to your holdings, your pending book is updated and displayed. This includes how those changes impact the market value, Greeks, cash, and maintenance margin requirement.

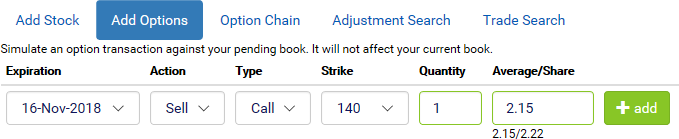

There are many ways to add positions to your pending book for experimentation, such as from the trade analyzer or option charts. You can also manually add stock or options using the tabs at the bottom of the page.

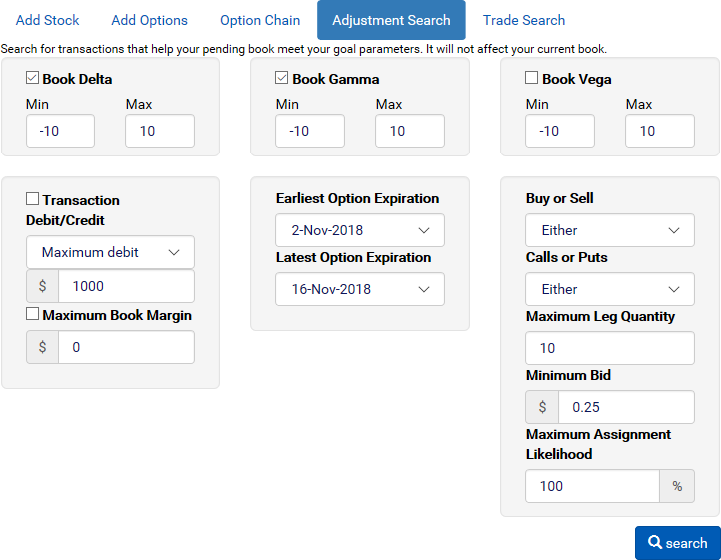

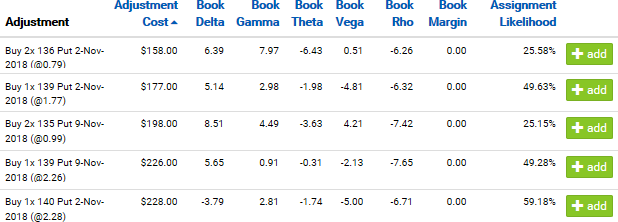

However, sometimes it’s hard to figure out the most efficient ways to meet your book goals. This is where the Adjustment Search comes in. It helps you find single-leg trades that help you reach a target book state. For example, let’s say you want to neutralize both delta and gamma. But you also only want to do it with options expiring across three dates and only want to trade a maximum of 10 contracts that have a bid of at least $0.25.

The adjustment search will provide a sortable list that enables you select the most efficient way to meet your target book in a single click. This is particularly useful when employing a strategy that involves collecting a variety of option positions based on volatility or other technical metric.

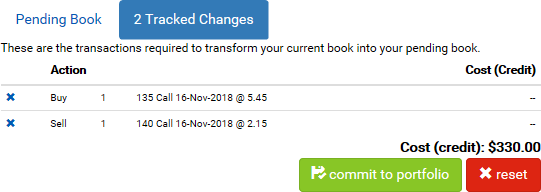

You can review pending changes to see the execution plan for efficiently updating your current book to match the pending one. This accounts for any redundant moves, such as if you add multiple positions that cancel each other out. If you have a linked account, you can send these changes right to a trade ticket. You can also reset the changes to return to your current holdings.

To learn more, please check out the book manager series on YouTube: