For many investors, landing an arbitrage trade is the ultimate goal. They can come in many forms, but the result is the same: risk-free profit.

But since the return of an arbitrage position is guaranteed, they can be a challenge to open. As a result, you will generally have to “leg in” to a trade. This means that you can’t place it as a single order and expect it to fill, but rather need to open it using multiple orders.

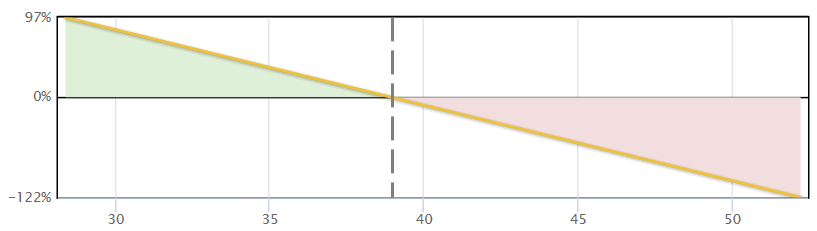

One of the most accessible arbitrage trades is the forward conversion. In this strategy, you own 100 shares of the underlying stock. A stock position carries a delta of 1 per share by definition, so this would give you 100 delta.

At the same time, you also hold a synthetic short stock position, which is made up of a long put paired with a short call struck at the same date and price. This option position will carry a delta of -1 per share, or a net -100 delta.

Because the trade results in a net delta and gamma of 0, any change in value in the underlying cancels out.

So where does the profit come from for forward conversions? Well, there are two places.

The first one is that you get to keep any dividends issued while you hold the stock. However, you should be careful of holding short call positions through the ex-dividend date as these are likely to be assigned to call away your shares if the dividend exceeds the remaining time value of the option. This dividend should be at least partially priced in to the costs of opening the option positions, but there’s often some edge available.

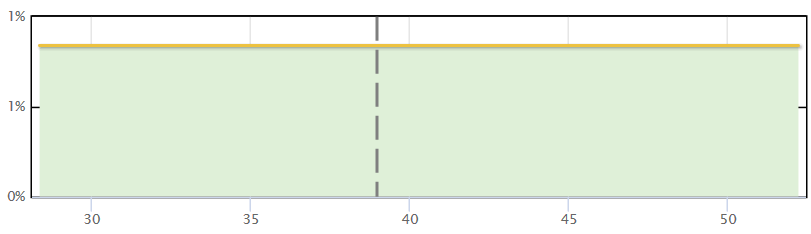

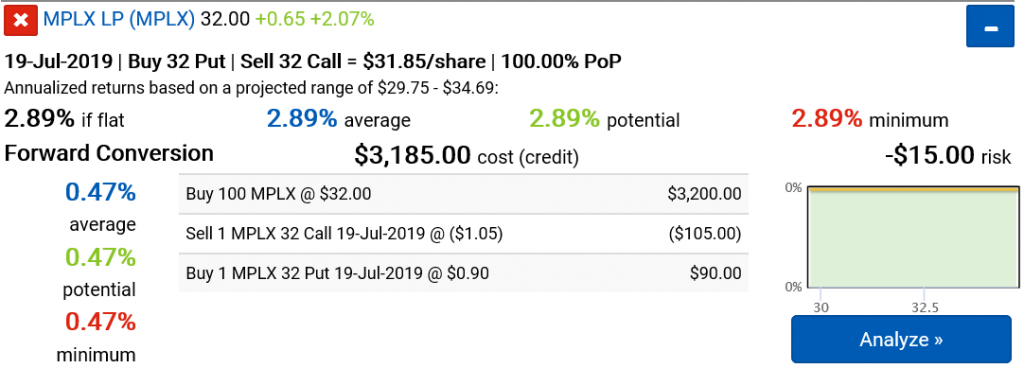

The other place to profit from is for the difference in the entry credit or debit for the option position relative to its strike price. This might sound pretty complicated, so let’s break it down. Suppose you found a stock trading at $32 with no dividends expected. Buying 100 shares would cost you $3,200. At the same time, the synthetic short position struck at 32 could be opened for a net credit of $0.15/share, or $15 per contract.

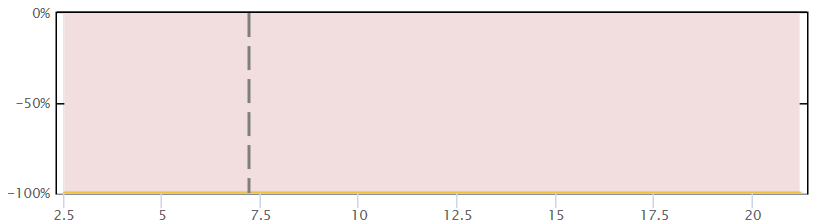

Since all underlying movement in the stock would be cancelled out among the positions held, the $15 would be a locked-in gain (this can be thought of as a net negative risk). Of course, you should also account for commissions, exchange fees, etc. Fortunately, it’s not much of a factor if you’re trading commission-free.

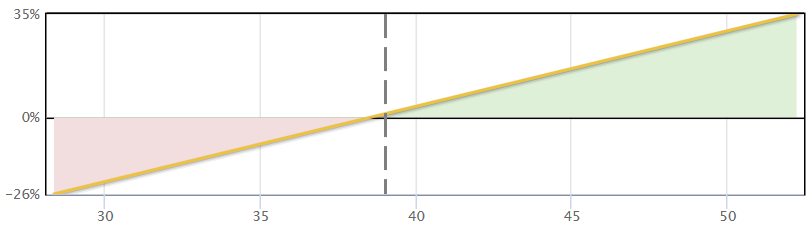

Just like forward conversions, there are also reverse conversions. As you would expect from the name, these trades are just inversions. You can enter them by shorting the stock and opening a synthetic long.

The return may not look great because you’ll generally lock in a guaranteed loss. However, there is an opportunity to view this as a low-interest loan, if you have the ability to apply the credit toward other investments.

Like the forward conversions, you’ll need to watch out for some special situations. Since you’ll be short stock, you will be responsible for delivering any dividends to the original owner you borrowed the stock from. You’ll also be at risk of early assignment of your short puts, which will cancel out your short stock position if assigned. This can happen when interest rates rise to the point where the cash is more valuable than the time remaining on the put. And since rates are fluid, this is relatively unpredictable for puts with little time value remaining.

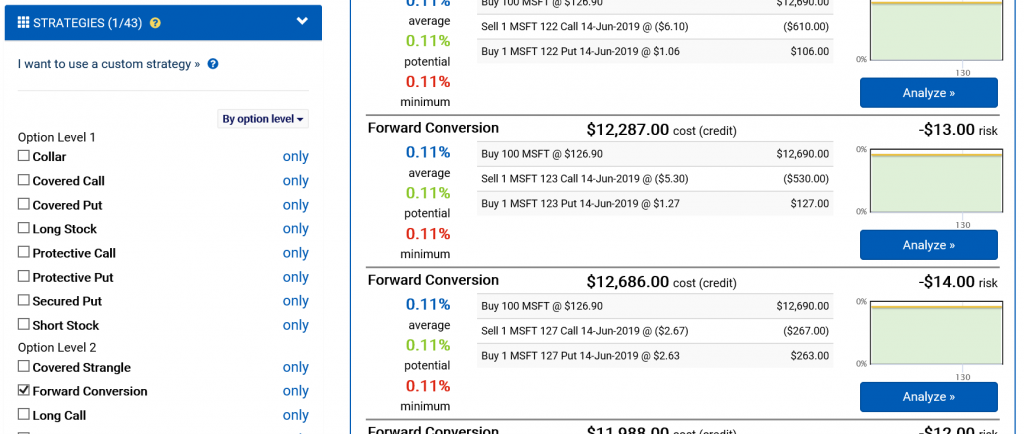

Quantcha provides a variety of ways to discover and manage arbitrage opportunities. First, you can filter for them using the option search. This is idea if you already have a stock and expiration in mind.

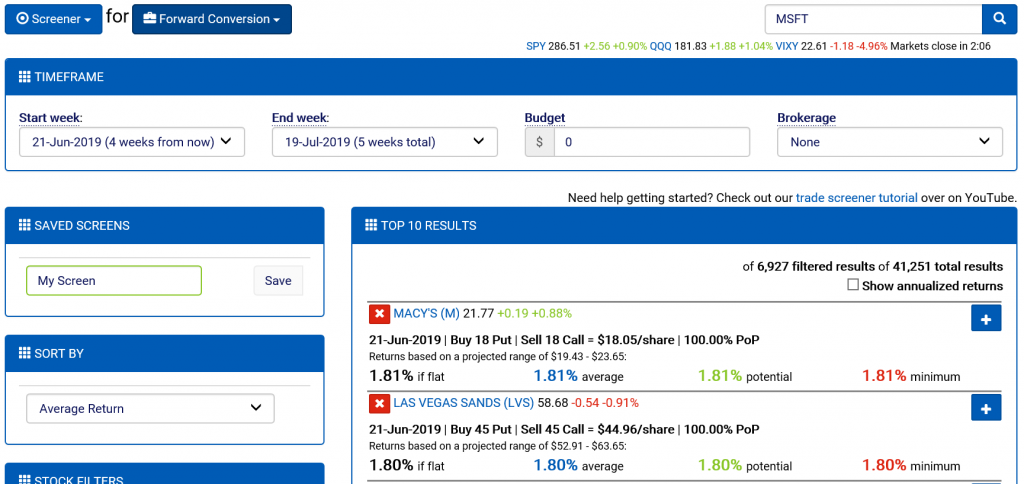

You can also use the screeners to filter and sort opportunities across the universe of optionable stocks.

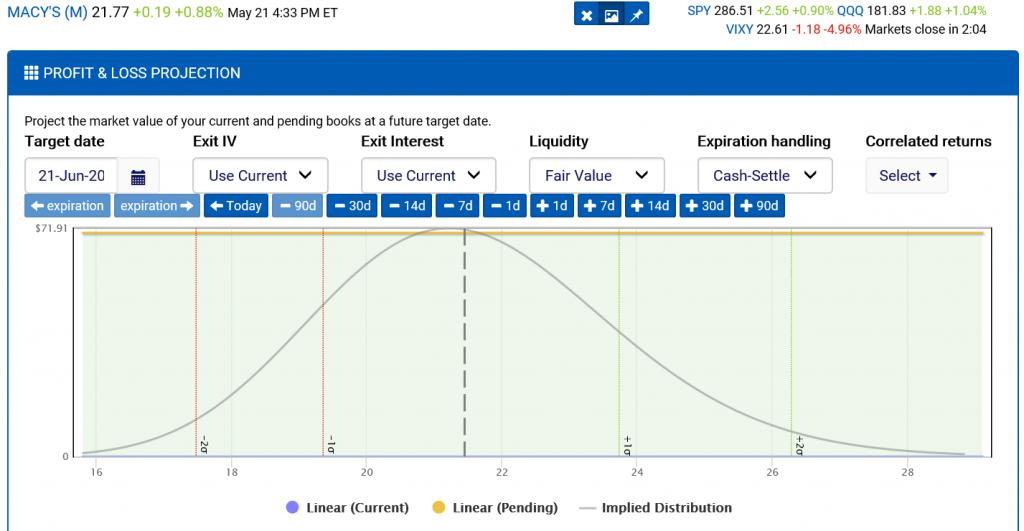

Once you find an interesting opportunity, you can analyze and optimize it using the book manager. This is also a great way to experiment with ways to lock in gains on positions you already have open using similar techniques.

Before diving into an arbitrage opportunity, be sure to consider all the angles. These opportunities aren’t supposed to exist in an efficient system, so if you’re seeing the potential for an outsized reward for a given investment, there may be additional risks you’re not aware of. Double-check key data like prices, expected dividends, and potential interest rate moves. American options allow early assignment, which can put you in a difficult situation if you are trading at scale that could expand beyond your capital. There are also liquidity considerations when it comes to entering and exiting positions, such as the width of the bid/ask spread of lightly traded options.

Interested in learning more about conversions? Be sure to check out Why do investors use forward or reverse conversions?.