Options provide incredible flexibility for investors to express complex views, but it comes with great risk.

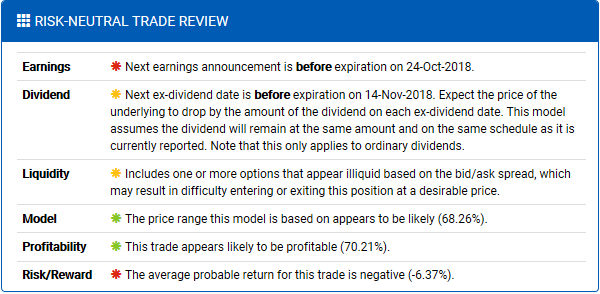

Both our options search engine and trade strategy screeners feed prospective trades through our in-depth trade analyzer so you can get a deeper understanding of your prospects. The first thing you’ll see is our risk-neutral trade review. This is a summary of the key aspects you care about for any trade, such as earnings & dividend dates, option liquidity, and multiple risk/reward metrics.

The analysis will also include important details, such as the execution plan, as well as the projected commissions and fees for your brokerage.

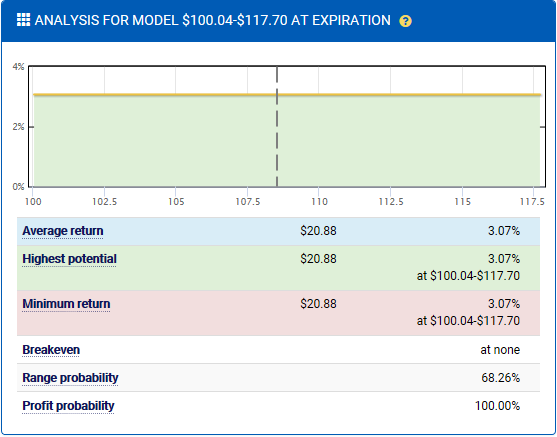

The projected payoff diagram for the trade at expiration based on your supplied model. This shows you how the trade will perform if things go according to your current view.

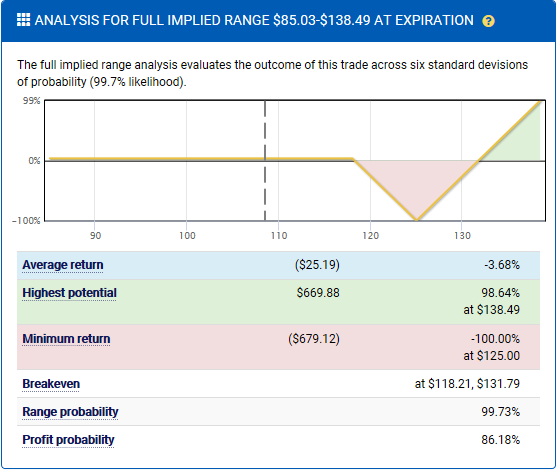

You’ll also see a payoff diagram for the full implied range of the underlying. This range includes a +/- 3-volatility movement based options market sentiment that covers over 99% of likely outcomes. It’s an invaluable view into what can happen if the underlying doesn’t play along with your expectations.

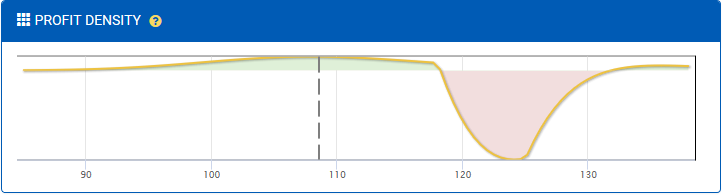

The profit density diagram marries the implied distribution (probability of each terminal price) with the payoff diagram (return at each terminal price). This plays an important role in illustrating where the profit and risk live along the potential outcomes weighted by their likelihood.

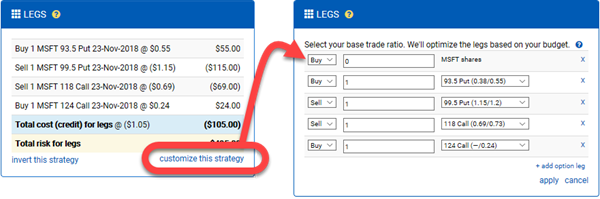

You can even invert your entire trade or just customize the legs to craft the ideal trade you’re looking for.