There is a wealth of information locked away in your option transaction history, but it can be really difficult to put into practice.

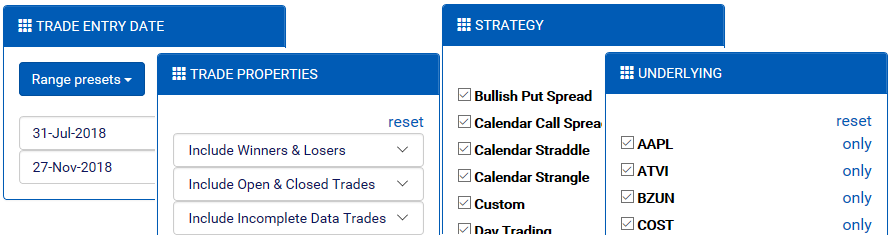

Our performance tracking tools do all the heavy lifting for you. We import the transaction history from your linked brokerage account and translate it into actionable intel you can use to improve your trading habits. Where available, we also apply your recently filled orders and current portfolio holdings to fill out a complete picture of your trading performance.

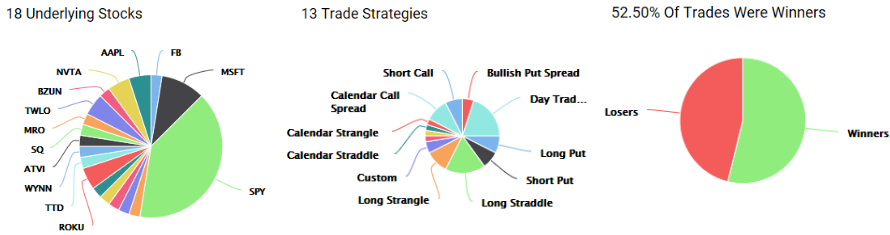

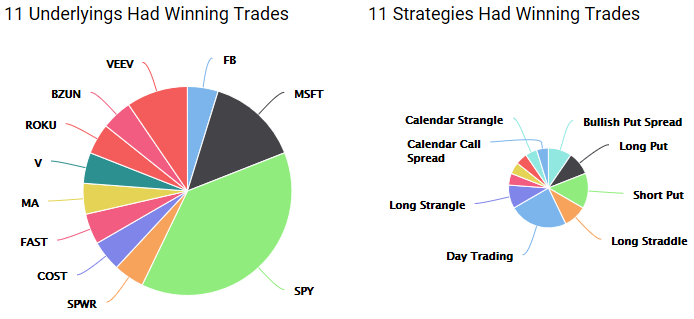

Trade strategies are inferred from opening transactions. Each trade is then followed through closes, expirations, and rolls until the eventual exit. This data is then used to generate colorful charts that make it easy to identify what you’ve been trading and how. While this is truly valuable insight, it also opens a new opportunity for deeper analysis of your trading habits.

To support this, you can easily filter down to find specific groups that are outperforming in order to zero in on exactly why you’re getting such great returns. At the same time, you can also identify which kinds of trades haven’t worked out in order to improve them or just cut the ideas altogether. And when you identify a class of trades that is really winning or losing, it’s important to understand exactly why.

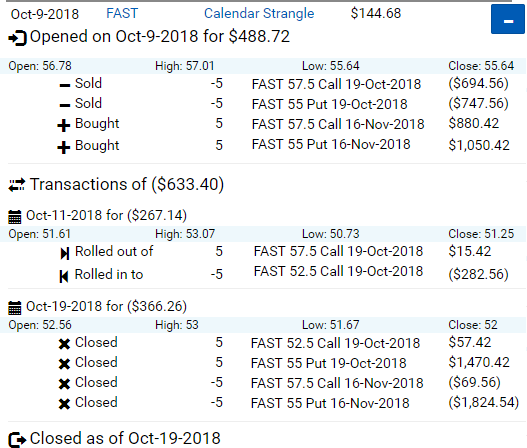

The Trades tab provides a sortable list of the trades that fit your filter requirements. These trades are assigned a strategy based on the net collection of transactions that occurred on the day they were opened. These are the same trades used to generate the charts, but in tabular form. For example, let’s say you opened a long straddle for 60 days out. If you opened a short straddle for 30 days out on the same day, this would be interpreted as a calendar straddle. However, if you opened the short straddle the next day, they would be treated as two separate strategies.

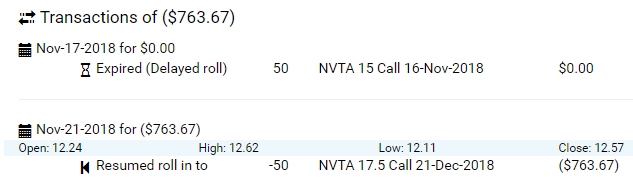

You can expand any of the trades to view its execution history. We attempt to map transactions that occur into open trades when there is a fit. For example, you may roll a single leg to a new strike, which we will detect and apply if there is a fit.

We’ll even attempt to identify “delayed” rolls. These are situations where you close or expire a leg and then replace it with a new leg at a later date. Each day also includes reference pricing for the underlying to make it easier to recall the rationale that may have helped drive your decisions. This offers a unique opportunity to learn from trade history.

If you’d like to learn more about out our option trade tracking and reporting, check out our video on YouTube: